ETH derivatives volume suggests that Ethereum investors have little confidence in the Spot Ethereum ETFs, sparking a massive rally for the second-largest crypto token by market cap. This development comes amid the imminent launch of these funds, which are expected to begin trading next week.

Ethereum Futures Premium Highlights Little Confidence In ETH’s Price

According to data from Laevitas, Ethereum’s fixed-month contracts annualized premium currently stands at 11%, suggesting that crypto traders aren’t bullish enough on ETH’s price. Further data from Laevitas shows that this indicator has yet to sustain levels above 12% this past month.

This is surprising considering that the Spot Ethereum ETFs, which could launch next week, are expected to spark a price surge for Ethereum. Crypto analysts like Linda have predicted that ETH could rise to as high as $4,000 thanks to the inflows these Spot Ethereum ETFs could witness.

However, crypto traders are not convinced that Ethereum’s reaching such heights is likely to happen, at least not soon enough. A plausible explanation for this lack of excessive bullishness is that Ethereum’s price could continue to trade sideways for a while, thanks to the $110 million daily outflows that research firm Kaiko projected could flow from Grayscale’s Spot Ethereum ETF.

Moreover, this seems likely following the final S-1 filings by the Spot Ethereum ETF issuers, which showed that Grayscale has the highest fees. The asset manager plans to charge a management fee of 2.50%, while the highest fee among other Spot Ethereum ETF issuers is 0.25%.

Grayscale had done something similar with its Spot Bitcoin ETF, setting its management fee at 1.5%, while the other Spot Bitcoin ETF issuers had management fees ranging between 0.19% and 0.39%. That move is believed to have been one of the reasons why Grayscale’s Bitcoin ETF witnessed significant outflows following the launch of the Spot Bitcoin ETFs.

Making A Case For Ethereum’s Inevitable Price Surge

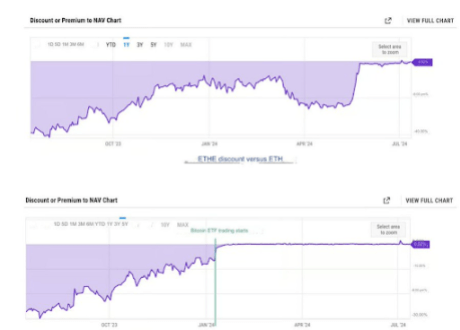

Crypto analyst Leon Waidmann has made a bullish case for ETH’s price and explained why Ethereum investors should be more bullish. He noted that the discount between Grayscale’s Ethereum Trust (ETHE) and ETH’s price has significantly narrowed since the Spot Ethereum ETFs were approved earlier in May.

Waidmann stated that this has given ETHE investors ample time to exit their positions without significant discounts compared to Grayscale’s Bitcoin Trust (GBTC). Another reason GBTC is believed to have experienced such outflows was because of investors who were taking profits from having invested in the trust at a discounted price to Bitcoin’s spot price.

However, unlike GBTC and other Spot Bitcoin ETFs, ETHE and other Spot Ethereum ETFs didn’t start trading immediately after approval. Therefore, Waidmann believes that whoever intended to profit from the discount between ETHE and ETH’s price must have already done so before now. As such, Grayscale’s ETHE shouldn’t witness the same amount of profit-taking as Grayscale’s GBTC did after it began trading.