According to the latest Binance Research report, the Ethereum (ETH) issuance rate continued to rise in September 2024, raising concerns about the digital asset’s “ultrasound money” claim.

Ethereum Issuance Rate Continues To Surge

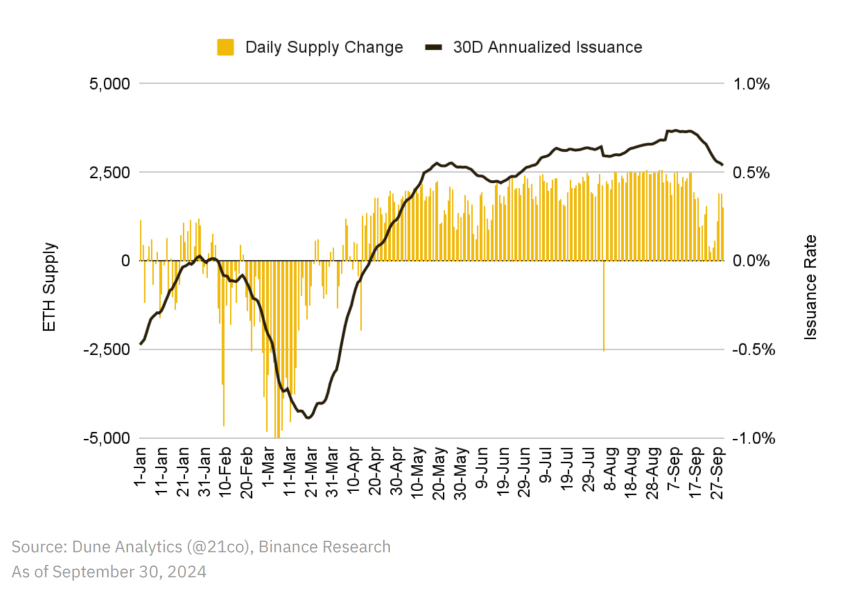

In its October 2024 Monthly Market Insights report, Binance Research highlighted that the ETH issuance rate continued its ascent in September, moving away from its previously deflationary status.

The second largest digital asset by reported market cap had a 30-day annualized inflation rate of approximately 0.74%, a level not observed in the last two years. The sharp uptick in ETH supply inflation has questioned its “ultrasound money” positioning.

Interestingly, the term “ultrasound money” draws inspiration from Bitcoin’s (BTC) “sound money” narrative. While BTC’s supply is capped at 21 million, ETH’s supply can become deflationary, theoretically increasing scarcity and protecting it from inflation-driven erosion of purchasing power.

Ethereum’s high issuance rate could be attributed to several factors, including low mainnet on-chain activity, leading to a low transaction fee and, consequently, lower ETH burn rates.

In 2021, Ethereum core developers implemented EIP-1559, which introduced a fee-burning mechanism that aimed to reduce ETH’s circulating supply, thereby creating deflationary pressure on the token.

However, with declining mainnet activity, the amount of ETH being burned is lagging behind the ETH issuance rate, leading to a net inflationary trend.

Notably, September 2024 experienced one of the lowest ETH burn rates since the highly anticipated Merge event, when Ethereum transitioned from a proof-of-work (PoW) to a proof-of-stake (PoS) consensus mechanism.

Ethereum Layer-2 Solutions To Blame For Low ETH Burn Rate?

The report points to March 2024 as the starting point of Ethereum’s inflationary trend, following the implementation of EIP-4844 or the Dencun upgrade, which reduced transaction costs on layer-2 scaling platforms such as Optimism (OP), Arbitrum (ARB), Base, and Polygon (MATIC). The report adds:

As L2s cannibalized network activity throughout the year – further impacted by broader market conditions – transaction fees and, consequently, burned fees on Ethereum declined, with September recording one of the lowest levels since the Merge. This has prevented ETH from decreasing in supply to remain deflationary, leading to the net positive daily supply changes we now see.

Recent trends corroborate the assertion above, as network activity on layer-2 solutions grows across different metrics. For instance, a report in July 2024 noted that daily active addresses and transaction volume on Polygon had soared significantly.

Similarly, decentralized finance (DeFi) activity on Arbitrum increased earlier this year when decentralized exchange (DEX) Uniswap surpassed $150 billion in total swap volume on the network.

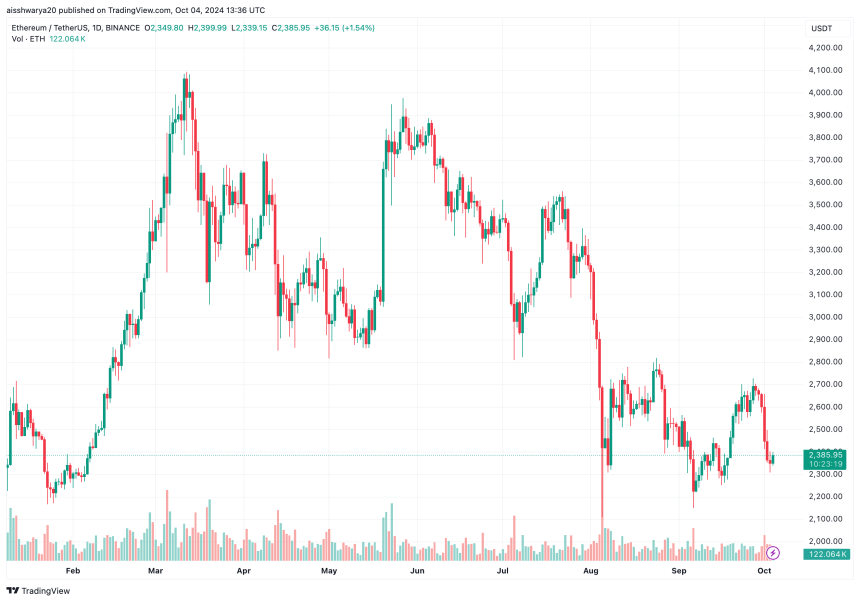

Another report found that over 48% of digital assets bridged from the Ethereum network end up on Arbitrum, indicating users’ high trust in the layer-2 network’s robust security and reliability. ETH trades at $2,385 at press time, up 1.7% in the past 24 hours.