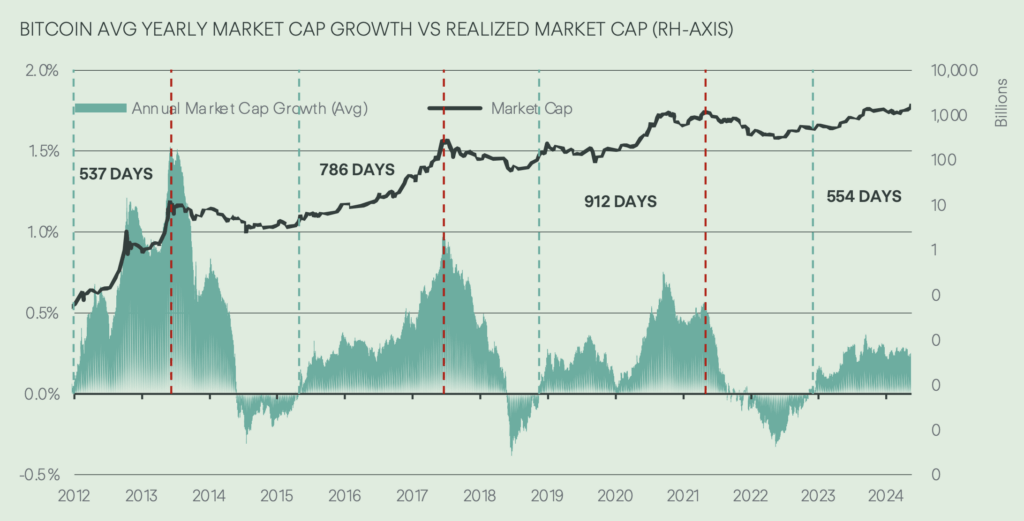

Bitcoin’s current market cycle indicates a potential peak in about 200 days, coinciding with forecasts of a possible US recession by mid-2025. According to recent research from Copper.co, this alignment emerges as Bitcoin reaches day 554 of its cycle.

Historically, Bitcoin’s market cycles average 756 days from the point when the annual average growth of its market capitalization turns positive until it hits a price peak. Copper.co assesses that the present cycle began around mid-2023, shortly before BlackRock filed for a Bitcoin exchange-traded fund. Bitcoin could peak around mid-2025, approximately 200 days from now, if the pattern holds.

Copper.co uses JPMorgan’s estimate of a 45% chance of a US recession occurring in the second half of 2025 to showcase a potential overlap of Bitcoin’s peak with economic downturn predictions, adding a layer of complexity to market expectations. Investors may find this intersection significant when considering portfolio strategies amid macroeconomic uncertainties.

Realized volatility for Bitcoin currently stands at 50%, reflecting the standard deviation of returns from the market’s mean return. Implied volatility, which gauges market expectations for future volatility, recently hit its highest level of the year. This suggests ongoing market turbulence as 2025 approaches, with a possible bullish undertone influencing trading behaviors.

Bitcoin’s Relative Strength Index (RSI) is at 60, significantly lower than previous bull market highs. Copper.co’s report highlights that by extending the RSI’s look-back period to four years—a timeframe that reduces short-term noise—the indicator shows substantial room for growth. This metric implies that Bitcoin could build momentum into the new year, potentially reaching higher valuation levels.

Inactive Bitcoin supply, representing coins held without movement for extended periods, is increasing amid record prices. This trend indicates that long-term holders maintain their positions, but vigilance is advised. Should these investors begin to move assets, it could signal shifts in market forces or profit-taking activities.

Per Copper.co’s analysis, combining these factors paints a nuanced picture of Bitcoin’s trajectory. The interplay between market cycles, volatility measures, and macroeconomic forecasts illustrates the importance of monitoring multiple indicators.

The post Bitcoin bull run could continue for 200 days before possible US recession – Report appeared first on CryptoSlate.