In the weeks leading up to President Donald Trump’s inauguration, the crypto market experienced significant volatility. The Bitcoin market’s maturity means it’s affected by a complex combination of institutional activity, macro events, price movements, and derivatives.

The week before the inauguration was particularly volatile, with Bitcoin and the broader institutional market affected.

Spot Bitcoin ETF flows are currently one of the best gauges of institutional sentiment. Net inflows show institutions and professional investors are increasing their BTC exposure, while outflows show a reduction in holdings that usually indicate either risk aversion or profit-taking.

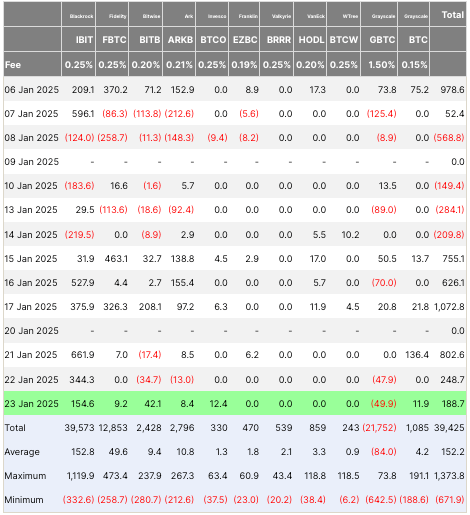

ETF flows showed a very cautious market during the first half of January. Outflows dominated the better part of last week, with Jan. 14 seeing a particularly sharp decline of 209.8 BTC. This drop followed Bitcoin’s price falling below $100,000, an important psychological level that reflected the market uncertainty ahead of the inauguration.

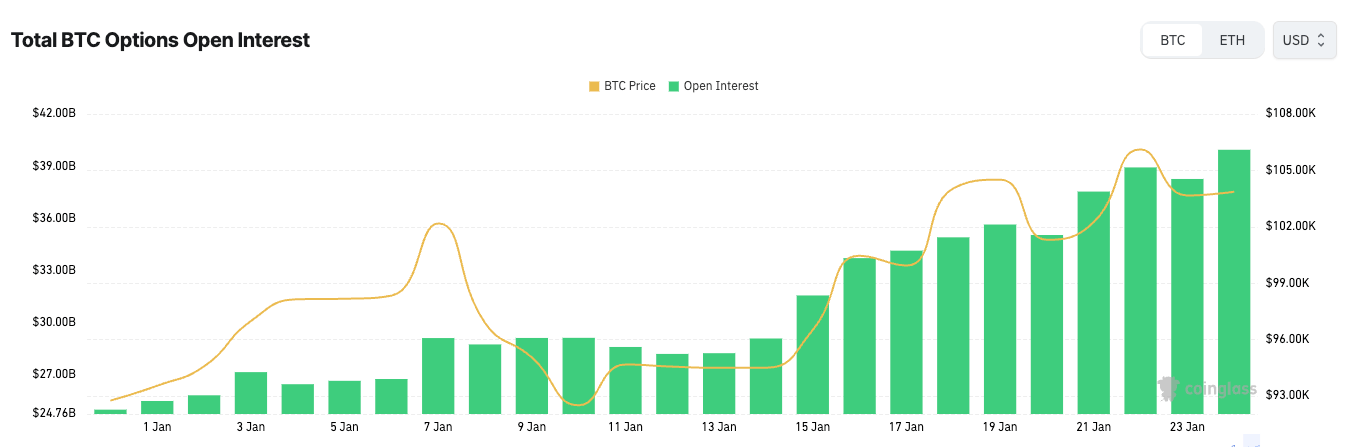

While ETF flows showed hesitancy before the inauguration, open interest in options steadily rose. Open interest refers to the total number of outstanding contracts in the options market. A rise in OI generally signals increased participation and interest in the market as traders and institutions position themselves for potential price movements.

Between Jan. 13 and Jan. 16, OI grew from $30 billion to $33 billion, even as ETFs saw outflows. This divergence shows institutions were not exiting the market entirely but were instead hedging their exposure to BTC through derivatives. By purchasing options that provide the right but not the obligation to buy or sell Bitcoin at a predetermined price, institutions protect themselves against downside risks.

However, this sentiment shifted after Jan. 16, and ETF flows turned positive the next day, Jan. 17, with a significant inflow of 1,072 BTC. This was accompanied by a continued rise in options OI, which climbed to over $35 billion by Jan. 19. Bitcoin’s price also showed signs of recovery during this period, reaching $102,000.

The increase in ETF inflows indicates a willingness to add spot exposure, while the rise in options OI reflects ongoing risk management. The dual use of ETFs and options shows how institutions navigate volatile markets by balancing directional exposure with strategic hedges.

Inauguration day brought back heightened volatility to Bitcoin. ETF flows turned negative again, with a net outflow of 284.7 BTC, signaling some profit-taking or continued caution among institutional investors.

However, options OI continued its steady climb, nearing $37 billion. Bitcoin’s price fluctuated significantly throughout the day but ultimately settled around $104,000. While some investors reduced their spot exposure, others likely used the options market to position themselves for potential volatility. The mixed ETF flows and rising OI indicate that institutions remained engaged in the market, even as they adopted a cautious approach.

The post-inauguration period saw a notable recovery in ETF flows. By Jan. 23, net inflows of 188.7 BTC suggested renewed optimism among institutional investors. Bitcoin’s price also recovered, surpassing $105,000, while options OI reached its highest level, approaching $40 billion. This alignment of ETF inflows, rising OI, and a recovering price reflects a market regaining confidence.

The steady increase in options OI throughout this period highlights the role of derivatives in providing flexibility and risk management for institutions. Even as ETF flows fluctuated, the consistent growth in OI shows that institutions were most likely not stepping away from Bitcoin but were instead leveraging the options market to navigate uncertainty.

Institutions are maturing in their approach to Bitcoin, utilizing both ETFs and options to manage their exposure. ETFs provide a straightforward way to gain or reduce Bitcoin exposure, while options offer the flexibility to hedge risk or take speculative positions. The rising OI, even during periods of ETF outflows, suggests that institutions are not simply reacting to short-term price changes but also factoring in broader macro conditions, such as political events and potential policy shifts.

The post As Bitcoin stirs, institutions hedge with ETFs and options appeared first on CryptoSlate.