Ethereum faced a brutal capitulation event on Sunday, plummeting over 30% in less than 24 hours as market-wide panic took hold. The dramatic sell-off was fueled by growing fears of a U.S. trade war, sending shockwaves across the crypto space and causing Bitcoin and major altcoins to drop significantly. ETH, which had been struggling to reclaim key levels, saw a sharp decline, shaking investor confidence and raising concerns about its long-term trend.

Top analyst Ali Martinez shared a technical analysis, revealing that Ethereum is forming a long-term head-and-shoulders pattern. According to Martinez, ETH must hold above the crucial $2,700 level to maintain its bullish structure and prevent a deeper correction. A breakdown below this level could trigger an extended bearish phase, further delaying ETH’s potential rally toward new highs.

With volatility at extreme levels and uncertainty dominating the market, Ethereum’s next move will be critical. If bulls manage to defend key support, ETH could stage a strong recovery, but failure to hold could lead to even more downside. As investors assess the damage from this weekend’s crash, all eyes remain on whether ETH can stabilize and reclaim momentum in the coming days.

Ethereum Faces A Key Challenge

Yesterday, the crypto market witnessed the largest liquidation event in its history, with over $2 billion wiped out in just a few hours. Fear has taken over, and investors are bracing for extreme volatility this week as the U.S. market reacts to escalating trade war tensions. With uncertainty dominating the landscape, Ethereum has been one of the most impacted assets, shedding a significant portion of its value as panic selling intensified.

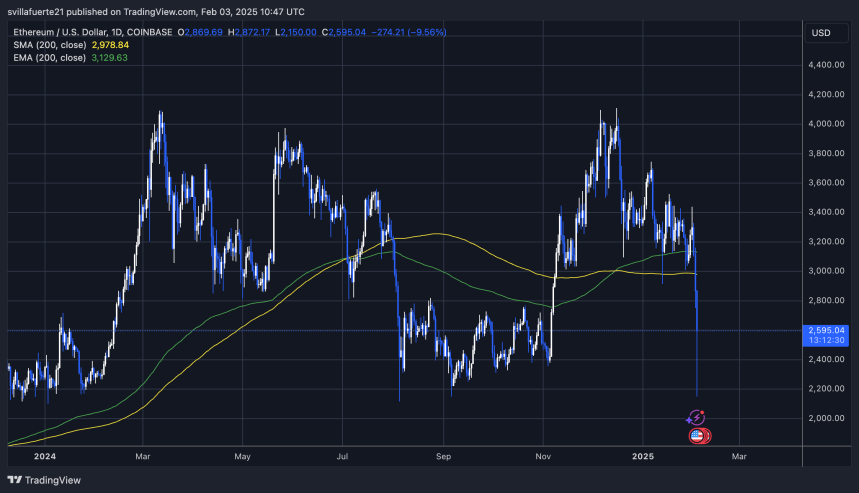

Ethereum’s price plummeted over 37% since last Friday, marking one of its sharpest declines in recent years. The dramatic downturn has led analysts to question whether ETH can maintain its long-term bullish structure or if a deeper correction is imminent.

Top crypto expert Ali Martinez shared a technical analysis on X, revealing that Ethereum appears to be forming a long-term head-and-shoulders pattern. If this pattern is confirmed, ETH must hold above the critical $2,700 mark to keep its bullish structure intact. Losing this level could trigger a deeper selloff, potentially pushing prices toward lower demand zones before any recovery takes place.

However, if bulls successfully defend this crucial support, Ethereum could still have a shot at reclaiming lost ground and targeting its long-term goal of $7,000. The coming days will be pivotal in determining ETH’s trajectory as traders assess whether this is a temporary shakeout or the beginning of a prolonged downtrend.

As macroeconomic fears and trade war tensions continue to influence market conditions, Ethereum’s price action will be a key indicator of broader investor sentiment. This week will likely set the tone for ETH’s movement in the coming months, making it a defining moment for the second-largest cryptocurrency.

Price Action Details: Key Levels To Watch

Ethereum (ETH) is currently trading at $2,595 after an extremely volatile Sunday that saw its price plummet to as low as $2,150. The drastic drop has left bulls in a precarious position, as ETH has lost all major support levels and is now searching for demand to stabilize.

With the market shaken and fear-dominant sentiment, ETH must hold above the $2,600 mark in the coming days to have a chance at recovery. However, after such a massive liquidation event, regaining bullish momentum may take time, and the likelihood of further downside remains high. Traders and investors are watching key levels closely as Ethereum struggles to find its footing.

If ETH manages to reclaim the $2,800 level and push above $3,000, confidence could return to the market, signaling the first steps of a recovery. Until then, uncertainty remains the dominant force, and the potential for another leg down cannot be ruled out. The next few days will be crucial in determining whether Ethereum can bounce back or if it will continue its decline toward lower support levels.

Featured image from Dall-E, chart from TradingView