Bitcoin is once again under pressure after falling more than 7% from its all-time high of $112,000. The sharp retracement has brought BTC down to a crucial support zone, and what happens next could determine the direction for the rest of the quarter. Global tensions between the US and China are intensifying, with tariff disputes resurfacing and adding stress to an already fragile market environment. This backdrop is fueling volatility and forcing investors to rethink their exposure to risk assets.

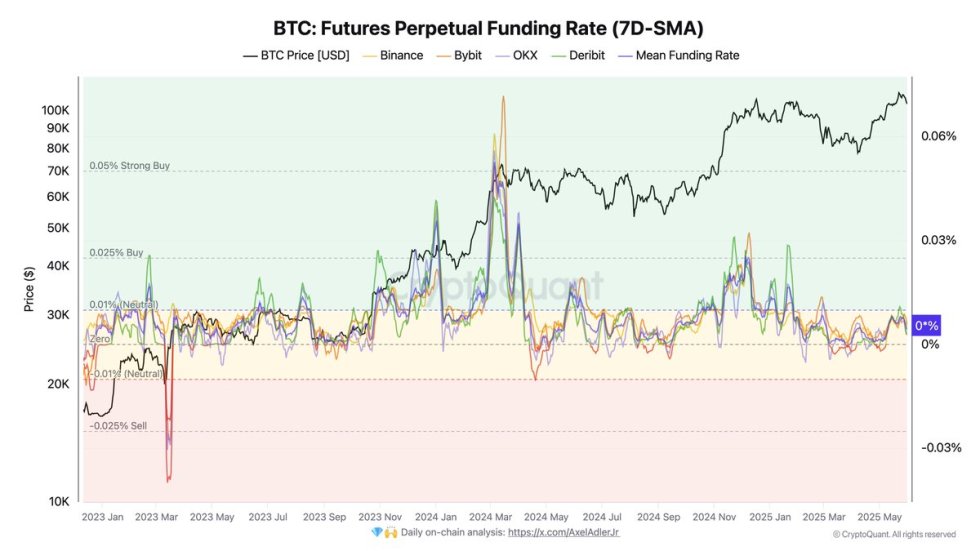

Top analyst Darkfost shared key insights revealing that funding rates remain unusually low across major exchanges. This indicates a clear lack of conviction among traders to open new long positions, especially in the derivatives market. Typically, a breakout above previous all-time highs would trigger euphoric behavior and rising leverage, but the current environment is marked by hesitation and caution.

While some interpret this as weakness, others see it as a healthy sign, suggesting the market isn’t overheated and may be building a stronger foundation for the next leg up. As BTC holds near key levels, all eyes are now on whether bulls can regain control or if a deeper correction is on the horizon.

Bitcoin Derivatives Market Signals Healthy Caution

Bitcoin is now facing notable selling pressure after consolidating just below its all-time high of $112,000. After weeks of strength, the current pullback suggests the market may enter a period of sideways consolidation as traders wait for fresh catalysts. Macroeconomic uncertainty continues to weigh on sentiment, especially as rising US Treasury yields raise concerns over systemic risk. These conditions are affecting not only Bitcoin but also the broader crypto market, including altcoins.

According to analysis by Darkfost, funding rates remain unusually low across most exchanges. This metric, which reflects the cost of holding leveraged positions in perpetual futures contracts, typically spikes during euphoric rallies. However, despite BTC hovering near its highs, investor appetite for long exposure remains subdued. This cautious stance is partly fueled by political uncertainty, as ongoing Trump-related developments add further unpredictability to global markets.

Interestingly, Darkfost notes that this low-risk environment in derivatives is actually a bullish signal in disguise. With short positions still significant, any sudden upside momentum could trigger a cascade of liquidations, accelerating a potential breakout. Furthermore, the absence of excessive leverage implies that the market is not overheating—a key factor in establishing a sustainable foundation for further gains.

In short, Bitcoin may be cooling off temporarily, but the structure beneath the surface remains strong. As long as funding rates stay balanced and systemic risk does not escalate further, the current pause could serve as a launchpad for the next impulsive move.

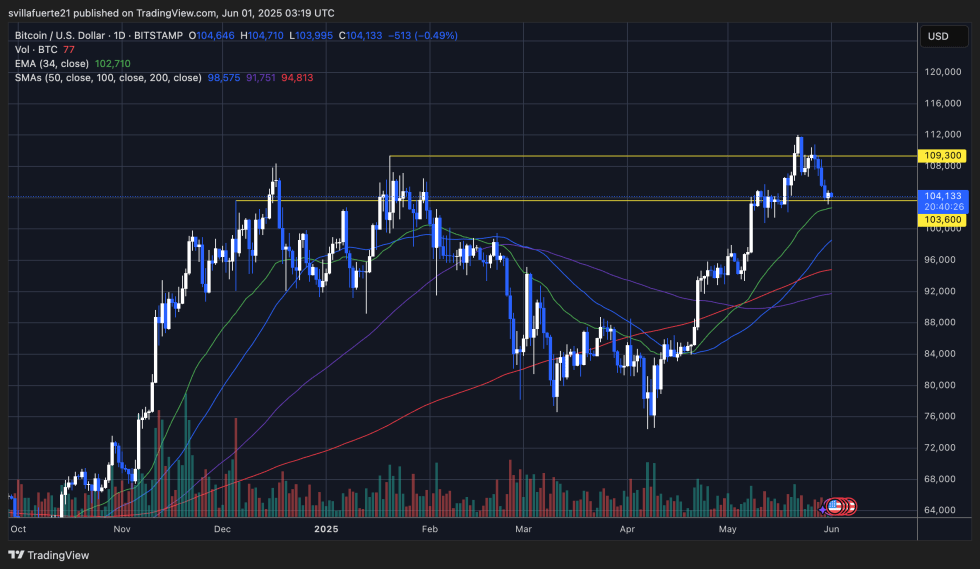

BTC Holds Support As Bulls Defend $103K–$104K Zone

Bitcoin is currently testing a critical support zone between $103,600 and $104,000 after failing to maintain momentum above its all-time high near $112,000. The chart reveals a strong rejection from the $109,300 resistance level, which previously acted as a key breakout point in May. The pullback has been accompanied by declining volume, suggesting that selling pressure may be slowing as price nears demand.

The 34-day exponential moving average (EMA), currently sitting at $102,710, is also converging with this support area, adding further confluence and technical significance to this zone. If bulls manage to hold above the $103,600 line, Bitcoin could form a higher low—a bullish structure that might set the stage for a rebound in the coming sessions.

However, a clean break below this level with strong volume would likely invalidate the short-term bullish thesis and open the door for a deeper correction toward the $98,000–$100,000 range. As global tensions and economic uncertainty remain elevated, this level will serve as a litmus test for market strength. For now, Bitcoin is still technically in an uptrend, but this support must hold to maintain bullish momentum heading into June.

Featured image from Dall-E, chart from TradingView