Bitcoin is currently trading above the $105,000 level after a volatile retracement from its all-time high of $112,000. Despite the recent price swings, BTC appears to be entering a consolidation phase, finding support at a key demand zone as global markets remain tense. Rising US Treasury yields and escalating macroeconomic uncertainty, particularly related to trade tensions and inflation risks, are weighing heavily on investor sentiment across asset classes, including crypto.

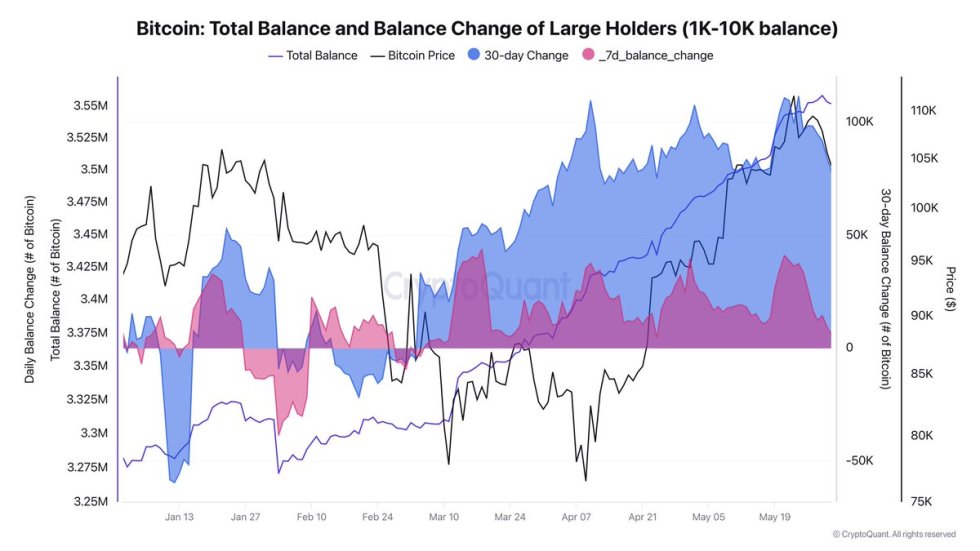

However, Bitcoin continues to show resilience in the face of systemic stress. According to fresh data from CryptoQuant, large holders—those with between 1,000 and 10,000 BTC—have been steadily increasing their positions. Since March 11, when BTC briefly fell below $78,000, this cohort has accumulated an additional 200,000 BTC, bringing their total holdings from 3.3 million to 3.5 million coins. This sustained accumulation by whales suggests that long-term confidence in Bitcoin remains intact, even as the broader market navigates through uncertainty.

With consolidation underway and demand from key players rising, analysts are closely watching for the next major move. Whether BTC breaks out or pulls back further, the underlying accumulation trend signals continued strength behind the scenes.

Bitcoin Faces Market Test As Whale Confidence Remains Strong

Bitcoin is currently navigating a pivotal phase, having dropped over 7% from its all-time high of $112,000. As the asset consolidates near the $105,000 level, investors are closely watching how it reacts to growing macroeconomic uncertainty. Global tensions between the US and China, particularly around trade tariffs, are reshaping market dynamics and injecting volatility across risk assets. Despite this turbulence, Bitcoin remains a standout performer since 2021, outperforming most altcoins that continue to lag behind their previous cycle highs.

What’s notable during this pullback is the sustained confidence shown by large Bitcoin holders. According to an analysis shared by top analyst Darkfost, the supply held by addresses with 1,000 to 10,000 BTC has increased significantly since March 11, when BTC briefly dipped below $78,000. These whales have added 200,000 BTC to their holdings, growing from 3.3 million to 3.5 million BTC in under three months.

On a shorter timeframe, 78,000 BTC were accumulated in the past 30 days, with 6,000 BTC added in just the last week. While this pace has slowed compared to earlier periods, the trend remains decisively bullish. Even after the May 23 ATH, accumulation continues, indicating that large players are positioning for further upside.

BTC Price Analysis: Testing Support Amid Ongoing Consolidation

Bitcoin is currently trading at $104,430, showing signs of consolidation just above the key support at $103,600 after pulling back from the recent all-time high at $112,000. The chart indicates a clear rejection near the $109,300 resistance zone, which has now been tested multiple times without a successful breakout. Despite the rejection, the price remains structurally bullish as long as BTC holds the $103,600 level, which also aligns with the rising 34-day EMA currently around $102,893.

Volume has declined slightly during the retracement, suggesting the pullback may be more corrective than impulsive. Meanwhile, the 50-day and 100-day SMAs continue to slope upward, reinforcing a mid-term bullish bias. If bulls can maintain price action above the $103,600 support, a renewed push toward $109,300 becomes likely.

However, a breakdown below $103,600 would open the door to deeper downside risk, with potential targets near the $99,000–$100,000 range where the 50-day SMA offers additional support. Market participants should monitor whether BTC can hold this consolidation zone as macro uncertainty, including rising US Treasury yields and geopolitical tensions, continues to weigh on broader sentiment. Holding current support would signal resilience and set the stage for another breakout attempt in the coming days.

Featured image from Dall-E, chart from TradingView