Bitcoin continues to navigate a turbulent macro and geopolitical landscape, holding strong above the crucial $104,000 support level despite facing heightened volatility. The recent escalation of the conflict between Israel and Iran has injected a fresh wave of uncertainty into global markets, with growing speculation that the United States could become more directly involved. This possibility has rattled investors, fueling fear and casting a shadow over risk assets, including cryptocurrencies.

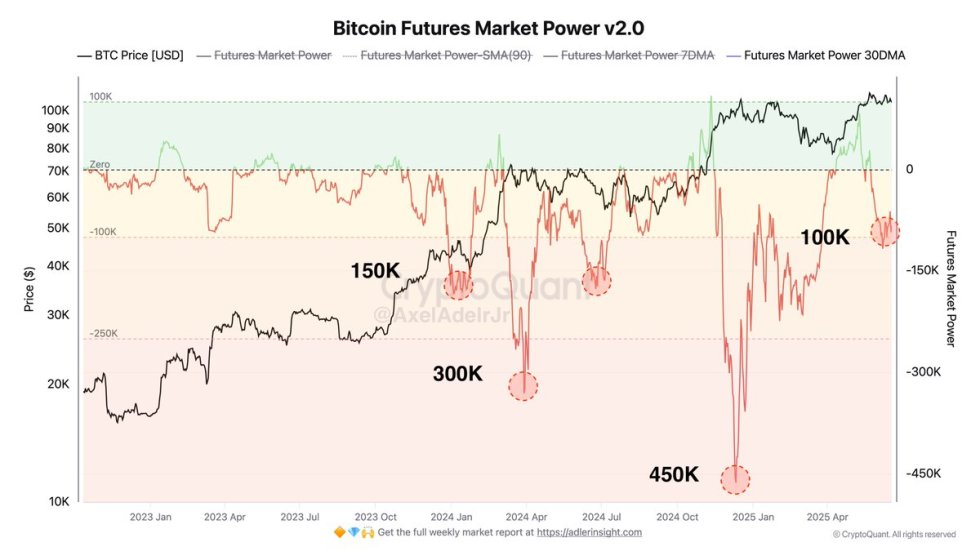

Yet, Bitcoin’s resilience stands out. While short-term selling pressure and volatility have emerged, BTC remains confined to a relatively narrow range just below its all-time high of $112,000. According to new insights from CryptoQuant, as of June 18, Futures Market Power sits at –93K, suggesting a moderately bearish tilt. However, this reading lacks the intensity typically seen during aggressive market selloffs.

Historically, similar bearish spikes within the –50K to –150K range have led to shallow corrections of just 5–10%, indicating that the current setup may reflect cautious optimism rather than genuine downtrend momentum. Bitcoin’s ability to remain elevated in the face of external pressures suggests that the market may be preparing for a decisive move once geopolitical tensions ease or clarity returns.

Bitcoin Consolidates At Key Demand Zone Amid Market Uncertainty

Bitcoin is currently trading at a key demand level between $104K and $106K, a range that may prove pivotal in the days ahead. After an explosive rally from the $74,000 level to the $112,000 all-time high earlier this year, BTC has entered a phase of sideways consolidation. This pause comes as traders and institutions await clarity on several macroeconomic and geopolitical fronts.

Despite rising volatility, Bitcoin has maintained strength above the $105K mark, a signal that the broader market sees this level as structurally important. The coming weeks will be critical in determining whether Bitcoin can break above its current range or face deeper pullbacks, especially as the Middle East conflict between Israel and Iran evolves and continues to shake global sentiment.

On-chain data supports this indecisive but resilient behavior. According to analyst Axel Adler, as of June 18, Futures Market Power stands at –93K. While this shows a moderate lean toward bearish positioning, it does not indicate intense or aggressive selling pressure. In fact, BTC has held relatively firm near its all-time highs.

Compared to historical context, this bearish positioning is weaker than past episodes—like in January, April, and July 2024—where spikes between –50K and –150K only led to minor 5–10% corrections. This trend suggests that the current market structure may reflect cautious optimism rather than bearish dominance. If this zone holds and tensions de-escalate, Bitcoin could be setting the stage for a breakout toward new highs.

BTC Price Analysis – Holding Key Support Near $104K

Bitcoin is consolidating just above the crucial $104,000 level, forming a base at a zone that previously acted as resistance in late 2024. The chart shows BTC attempting to maintain this demand area after failing to break cleanly above $109,300, the current cycle high and local resistance. The price is compressing between this upper boundary and the $103,600 level, creating a tight range that often precedes a strong directional move.

The 50-day moving average (blue) is converging near current price levels, reinforcing the $104K region as a short-term support. This convergence of price and technical structure indicates buyers are stepping in to defend the uptrend. A clean break below $103,600 would be technically concerning, potentially opening the door to a retracement toward the 100-day moving average near $95,000.

Volume remains relatively stable during the consolidation, suggesting market participants are waiting for clarity amid geopolitical and macroeconomic uncertainty. If bulls regain control and push above $109,300 with conviction, BTC could re-enter price discovery mode. However, if this level continues to reject price advances, more downside pressure could build.

Featured image from Dall-E, chart from TradingView