In an announcement yesterday, Nasdaq-listed software company GameSquare Holdings revealed that it had purchased $5 million worth of Ethereum (ETH) as part of its $100 million ETH-focused treasury strategy. With this move, GameSquare joins a growing number of companies diversifying their corporate treasuries by investing in digital assets.

GameSquare Embraces Ethereum As Part Of Treasury Strategy

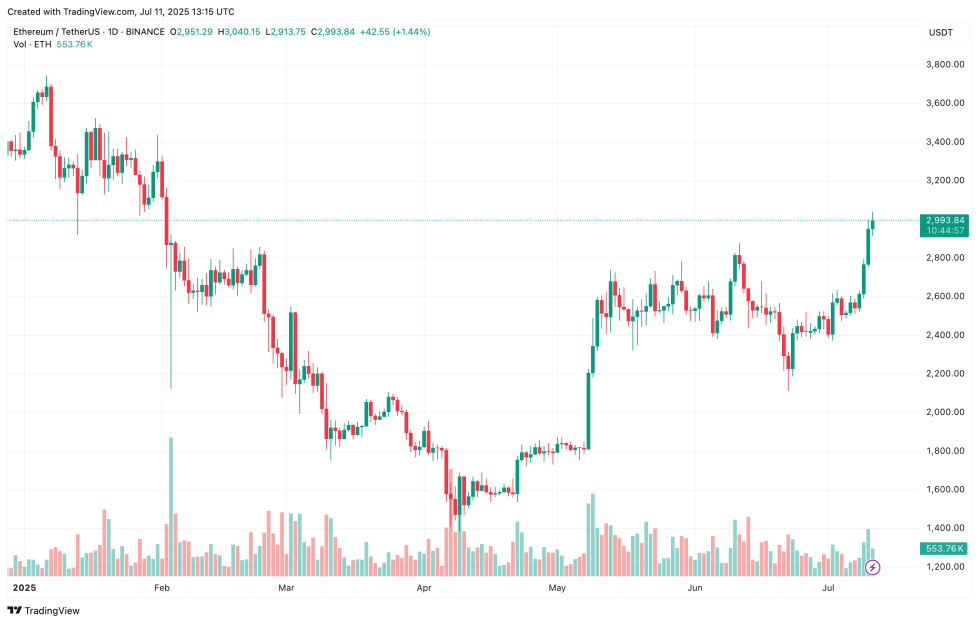

As the cryptocurrency market regains bullish momentum – highlighted by Bitcoin (BTC) reaching successive all-time highs (ATHs) over the past few days – mainstream interest in digital assets is once again surging. In this context, Ethereum continues to see rising adoption.

The Texas-based firm recently completed its initial ETH purchase, acquiring 1,818.84 ETH at a weighted average price of $2,749, totalling $5 million. This marks the first step in GameSquare’s broader plan to deploy $100 million into Ethereum and related digital assets.

The company’s strategy focuses on building a crypto-native treasury framework designed to generate sustainable, risk-adjusted yield through decentralized finance (DeFi) protocols and the broader Ethereum ecosystem. Commenting on the development, Justin Kenna, CEO of GameSquare said:

In partnership with Dialectic and Ryan Zurrer, we are leveraging Medici, Dialectic’s proprietary platform that combines machine learning, automated optimization, and multi-layered risk controls, to target best-in-class risk-adjusted yields of 8-14%, well above current staking benchmarks of 3-4%.

Unlike traditional treasury strategies focused around Bitcoin, GameSquare’s ETH allocation seeks to actively generate yield by engaging with DeFi infrastructure, rather than simply holding the asset. This signals a novel growing trend of companies favoring ETH over BTC for treasury diversification.

While pursuing higher returns typically involves increased risk, Medici’s reputation for advanced risk management and performance tracking offers a layer of confidence. As more companies embrace ETH-based yield strategies, DeFi protocols are likely to attract deeper liquidity over time.

Smart Money Accumulating ETH

Despite currently trading about 40% below its ATH of $4,878 – set back in November 2021 – Ethereum is seeing increased accumulation by large investors, often referred to as “smart money.”

For instance, recent on-chain data shows that ETH whales – wallets holding between 10,000 to 100,000 ETH – added heavily to their holdings earlier this month, scooping as much as 200,000 ETH.

Simultaneously, Ethereum-based spot exchange-traded funds (ETFs) are gaining traction. Data from SoSoValue indicates nine consecutive weeks of positive inflows as of July 10, reinforcing broader investor interest in ETH.

That said, some caution remains warranted, as not all ETH-focused treasury strategies have yielded favorable results historically. At press time, ETH trades at $2,993, up an impressive 7.4% in the past 24 hours.