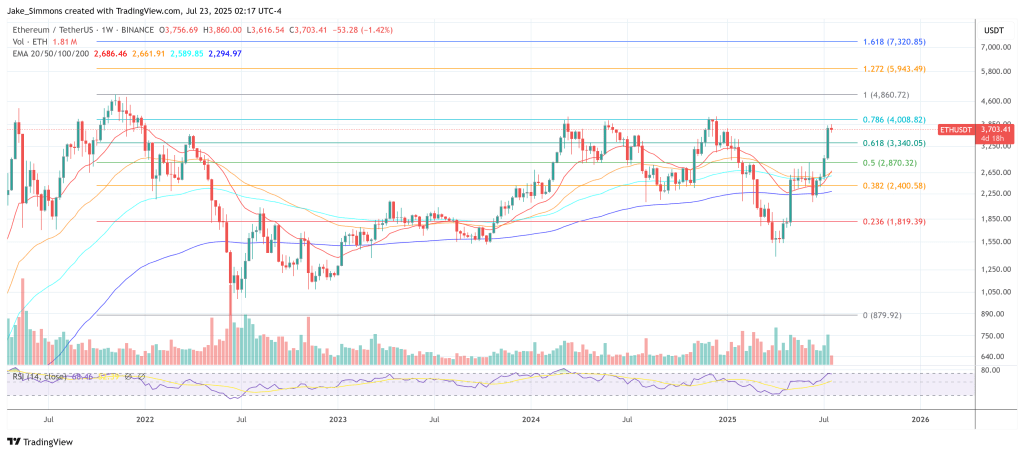

A sudden surge of institutional and corporate interest in Ethereum (ETH) is setting the stage for what Bitwise Asset Management’s chief investment officer Matt Hougan calls a “structural imbalance” between supply and demand—one that could propel prices well beyond the cryptocurrency’s already‑rapid ascent this year.

In a memo circulated to clients on 22 July 2025, Hougan noted that Ether has climbed more than 65 percent in the past month and over 160 percent since April. The rally, he argues, is being driven not by sentiment alone but by a dramatic mismatch between the amount of Ether produced by the network and the quantities now being absorbed by exchange‑traded products (ETPs) and newly formed “ETH treasury” corporations.

Ethereum Demand Shock Is Inevitable

“Sometimes it really is that simple,” Hougan wrote, echoing his long‑standing thesis that, in the short run, asset prices are dictated primarily by flows. He drew a direct parallel to bitcoin’s explosive performance following the launch of U.S. spot bitcoin ETPs in January 2024, when “ETPs, corporations, and governments acquired more than 1.5 million bitcoin, while the Bitcoin blockchain produced just over 300,000.”

The same dynamic, he contends, has finally taken hold in the Ether market—only more forcefully. Between 15 May and 20 July, spot Ether ETPs attracted more than $5 billion in net inflows, while a handful of publicly traded companies began stockpiling the token as a primary treasury asset. Among the most aggressive buyers:

- Bitmine Immersion Technologies (BMNR) accumulated 300,657 ETH—about $1.13 billion at current prices—and declared an ambition “of obtaining 5 percent of all ETH supply.”

- SharpLink Gaming (SBET) purchased 280,706 ETH ($1.06 billion) and disclosed plans to raise an additional $6 billion for future acquisitions.

- Bit Digital (BTBT) liquidated its bitcoin reserves after raising $170 million, redirecting the proceeds to more than 100,000 ETH (roughly $375 million).

- The Ether Machine (DYNX) outlined an initial public offering built around a $1.6 billion Ether treasury.

In aggregate, ETPs and public companies bought approximately 2.83 million Ether—valued at north of $10 billion—during the nine‑week stretch. Over the same period, the Ethereum network created only about 88,000 ETH in new issuance, a ratio of demand to supply that Hougan calculates at 32 to 1. “No wonder the price of ETH has soared,” he observed.

Whether that pressure continues is now the central question for investors. Hougan’s answer is an unequivocal yes. He points out that, even after the recent buying spree, Ether remains under‑owned relative to bitcoin in the ETP market: Ether funds control less than 12 percent of the assets held by bitcoin ETPs, despite ETH’s market capitalisation standing at roughly one‑fifth of BTC’s. “With all the excitement surrounding stablecoins and tokenization—which are primarily built on Ethereum—we think that will change,” he said, predicting billions of dollars in additional inflows “in the next few months.”

Meanwhile, the economics of listed “crypto treasury” firms appear to be self‑reinforcing. Shares of BMNR and SBET each trade at nearly twice the net value of the Ether they hold, a premium that incentivises management teams to issue equity, raise capital, and purchase still more ETH. “As long as that remains true, you can bet Wall Street firms will funnel money into more ETH purchases,” Hougan wrote.

Bitwise projects that ETPs and treasury companies could absorb as much as $20 billion worth of Ether—around 5.33 million coins at present prices—over the coming year. The protocol’s issuance schedule, by contrast, is expected to add only about 800,000 ETH to circulation during the same window, implying a 7‑to‑1 imbalance.

“That’s an even higher ratio than we’ve seen for Bitcoin since the spot ETPs launched,” Hougan said.

Sceptics often argue that Ether’s long‑term supply is not capped in the way bitcoin’s is, and that its valuation hinges on factors beyond simple scarcity, such as network usage and transaction fees. Hougan does not dispute those points but insists they are secondary in the near term. “In the short term, the price of everything is set by supply and demand, and right now, there is more demand for ETH than supply,” he concluded.

At press time, ETH traded at $3,703.