Bitcoin continues to hover around the $112,500 level, with volatility persisting across the market following last week’s historic crash. According to on-chain data, short-term holders (STHs) remain under heavy pressure, showing clear signs of panic. The STH realized price, a metric that tracks the average cost basis of recent buyers, indicates that many traders are still reacting emotionally to price fluctuations. The latest liquidation event seems to have deeply impacted market sentiment — even a small pullback yesterday was enough to trigger another wave of panic selling.

Yet, while some investors capitulate, others are seizing the opportunity. The famous Bitcoin OG whale, who gained widespread attention for shorting BTC and ETH right before the crash, has reportedly closed his position, locking in more than $197 million in profits. This move marks the end of one of the most successful short trades of the year.

As Bitcoin stabilizes within a tight range, the market remains divided between fear-driven sellers and opportunistic players positioning for the next major move. The coming days could determine whether BTC finds stability or faces renewed selling pressure from nervous short-term holders.

Bitcoin Whale Moves Cause Speculation

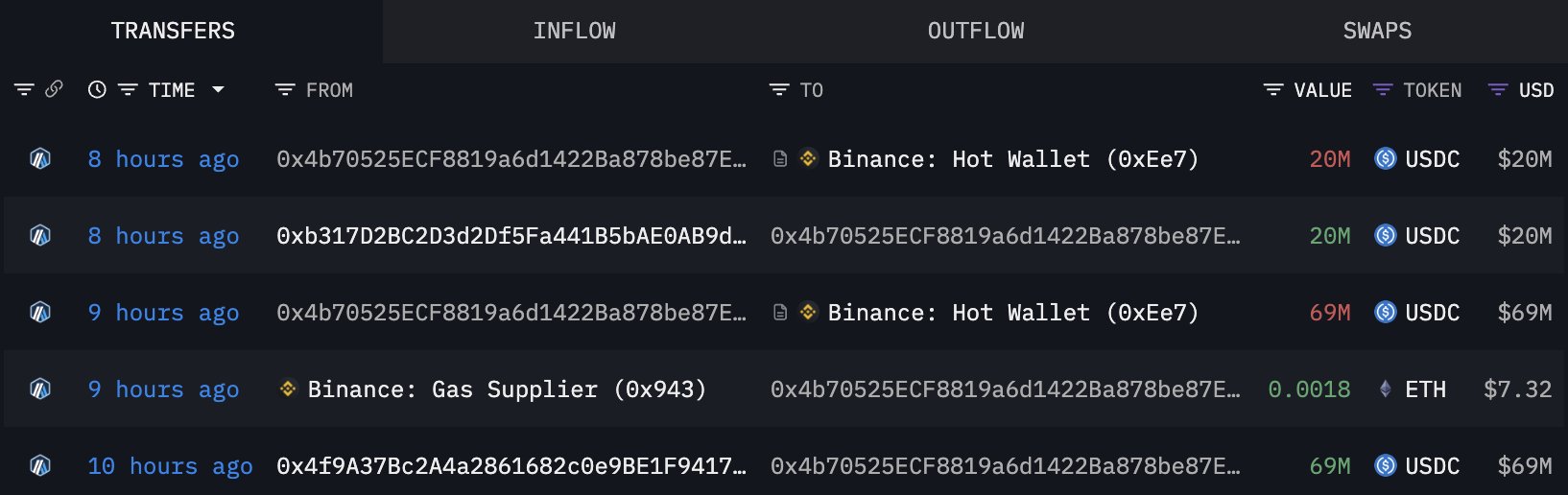

Lookonchain has tracked a series of high-stakes moves from the trader known as BitcoinOG (1011short) — one of the most closely watched whales in the market right now. The trader reportedly closed all BTC short positions on Hyperliquid, securing more than $197 million in profit across two wallets after last week’s crash.

Just hours later, the same wallet transferred $89 million USDC to Binance, immediately sparking speculation that the trader could be preparing to reopen short positions. Coincidentally, Bitcoin open interest on Binance surged by $510 million shortly after the deposit, adding fuel to theories that the whale may be behind the move.

While no direct link has been confirmed, analysts are split on whether this signals another round of aggressive shorting or simply capital repositioning. Some suggest the whale may be betting on further downside after Bitcoin’s failure to hold above $115K, while others believe the funds could be used for market-neutral strategies like hedging or arbitrage.

Still, the timing has left traders uneasy. The market remains fragile, and the whale’s actions — whether strategic or coincidental — could influence short-term sentiment as Bitcoin fights to defend support around the $110K region.

BTC Consolidates Below Pivotal Level

Bitcoin continues to face selling pressure as it trades around $112,500, hovering just above its short-term support zone. The daily chart shows that BTC remains trapped between the 50-day moving average (near $115,000) and the 200-day moving average (around $108,000), signaling an indecisive market. The repeated rejections near $117,500 — a level that acted as both support and resistance throughout the year — confirm it as a key supply zone.

The recent bounce attempts have been weak, with volume thinning and momentum indicators suggesting consolidation rather than a strong reversal. Bulls are struggling to reclaim control after the sharp sell-off that briefly sent BTC to $103K, and failure to hold above $110K could expose the next lower liquidity pockets around $107K and $105K.

On the other hand, holding above this range would stabilize market sentiment, allowing BTC to rebuild a base for a potential retest of the $115K–$118K area. For now, price action remains cautious — range-bound and reactive to broader risk sentiment. Traders are watching for a breakout above $115K or a decisive drop below $110K to confirm the next major directional move in the aftermath of last week’s volatility.

Featured image from ChatGPT, chart from TradingView.com