Ripple’s agreement to acquire GTreasury has triggered a sharp, technically informed reaction on X, where several long-time market observers argue the deal quietly routes XRP and Ripple’s stablecoin ambitions into the center of corporate finance. Their case rests on where GTreasury sits in the value chain, what it already connects to, and how Ripple can insert settlement choices—XRP or RLUSD—without forcing enterprises to change screens, ERPs, or bank relationships.

Why The GTreasury Deal Is Massive For Ripple And XRP

“I am pretty sure no one in crypto Twitter even understands what this is,” wrote developer Vincent Van Code (@vincent_vancode), before laying out why the plumbing matters. “GTreasury provides software that enables mainly large, multinational corporations [to] handle payments, liquidity, cash flow etc. The software links into banking and payment systems such as SWIFT, and is ISO20022 compliant.”

In other words, GTreasury is not a speculative bet on future rails; it is an orchestration layer that already standardizes and routes cash, messages, and risk data between a corporate’s bank portals, payment networks, and ERP.

Van Code’s key implication is distribution, not hype: “So this acquisition along with Hidden Roads and Standard Custody and Trust, allows Ripple to introduce digital assets into the $100T Treasury market. Ripple doesn’t need to ‘sell’ XRP to the big corporates, that is just part of the plumbing. The SaaS and UI doesn’t change, it just means Ripple progressively rolls out faster, more efficient rails. That’s the game.”

That line of thinking is echoed by Ray Fuentes (@RayFuentesIO), who argues the strategic shortcut is not merely technical but also legal and compliance-oriented. “Once this deal clears with GTreasury, Ripple will own a treasury platform already live in the SWIFT-interoperability lane. Translation: no building SWIFT integrations from scratch—there’s a legal, technical, and compliant path in place. HUGE win for enterprise adoption. #XRP.”

The point is less about a headline-grabbing re-architecture and more about a low-friction insertion into flows that already pass audit, security, and regulatory muster. If the bank and ERP adapters are in place, new settlement options can be exposed as toggles rather than rebuilds.

What Ripple Gets From The Acquisition

Wrathof Kahneman (@WKahneman) expands the distribution map and the product surface area by situating GTreasury in its historical and technical context. “They have ~40 years integrating w/ 800+ banks worldwide. They integrate directly with major ERP systems like SAP, Oracle, & NetSuite, and connects to leading banks like JPMorgan, Goldman Sachs, Bank of America, Wells Fargo, and PNC.”

That list matters because corporate treasurers don’t buy ledgers or tokens; they buy time-tested connectivity that won’t break cash positioning, FX hedging, pooling, and reconciliation. The argument is that once Ripple owns the connectivity fabric and the user interface, it can surface settlement paths—on-ledger via XRP, on-chain via RLUSD, or status quo—behind an unchanged workflow.

This is also why @WKahneman frames the deal as “Direct access to the corporate global money movement. With this Ripple can bring #RLUSD & #XRP settlement options into existing treasury workflows. A co could move funds across subsidiaries, currencies, or counterparties instantly, w/ changing software or banks. It’s the last mile for corporate finance.”

The operative phrase is “existing treasury workflows.” Treasurers remain inside SAP, Oracle, or NetSuite, while GTreasury orchestrates bank messages and payments. If Ripple can slot XRPL or RLUSD as routable options under that orchestration, the adoption barrier becomes a policy decision, not a systems project.

The Long-Term Plan

The purchasing pattern that led here is not incidental. @WKahneman tallies the stack: “Metaco – $250 million (2023) / Hidden Road – $1.25 billion / Rail – $200 million / GTreasury – $1 billion. Ripple has spent ~$3b building a complete corporate finance stack. They can offer every layer between a corporate CFO’s dashboard and on-chain settlement.”

Framed this way, Metaco covers custody and tokenization controls; Hidden Road adds institutional execution and collateral plumbing across venues; Rail supplies stablecoin payment orchestration; GTreasury becomes the corporate command console with bank and ERP integrations.

This in turn raises the question most readers leap to: how, exactly, does this touch XRP? @WKahneman does not over-promise but draws the strategic circle: “I know, I know,… ‘but what about XRP?’ I will leave it to you to consider what the implications are for a company that was built around the XRPL becoming embedded in corporate finance while holding 40% of the XRP supply. It’s important market penetration.”

The assertion is not that XRP becomes mandatory; it is that XRP becomes native—present at the point of decision inside treasury workflows where speed, pre-funding, and FX paths are calculated. If the “bridge asset” case is ever to be tested at scale, it will not be via retail speculation but via the quiet default settings of treasury middleware.

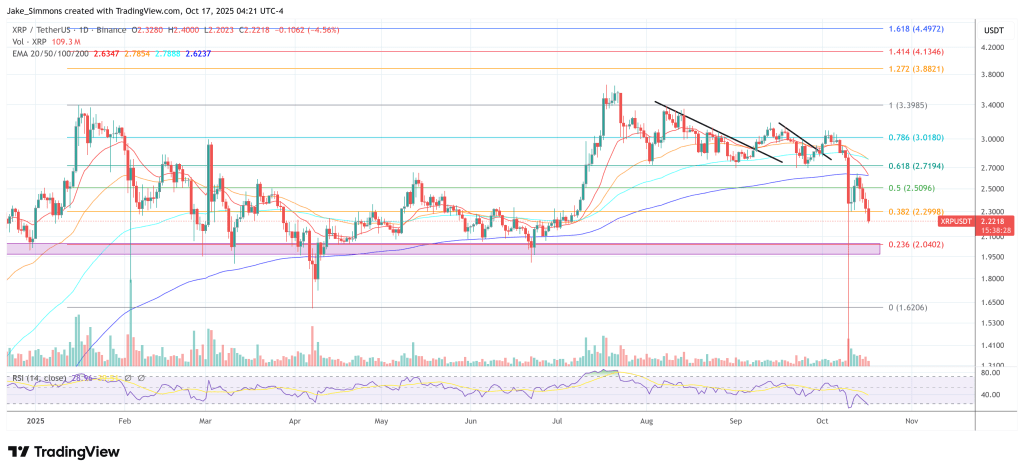

At press time, XRP traded at $2.22.