Bitcoin Magazine

Bitcoin Price Sits Down Over 30% From All-Time Highs as Market Waits for Next Catalyst

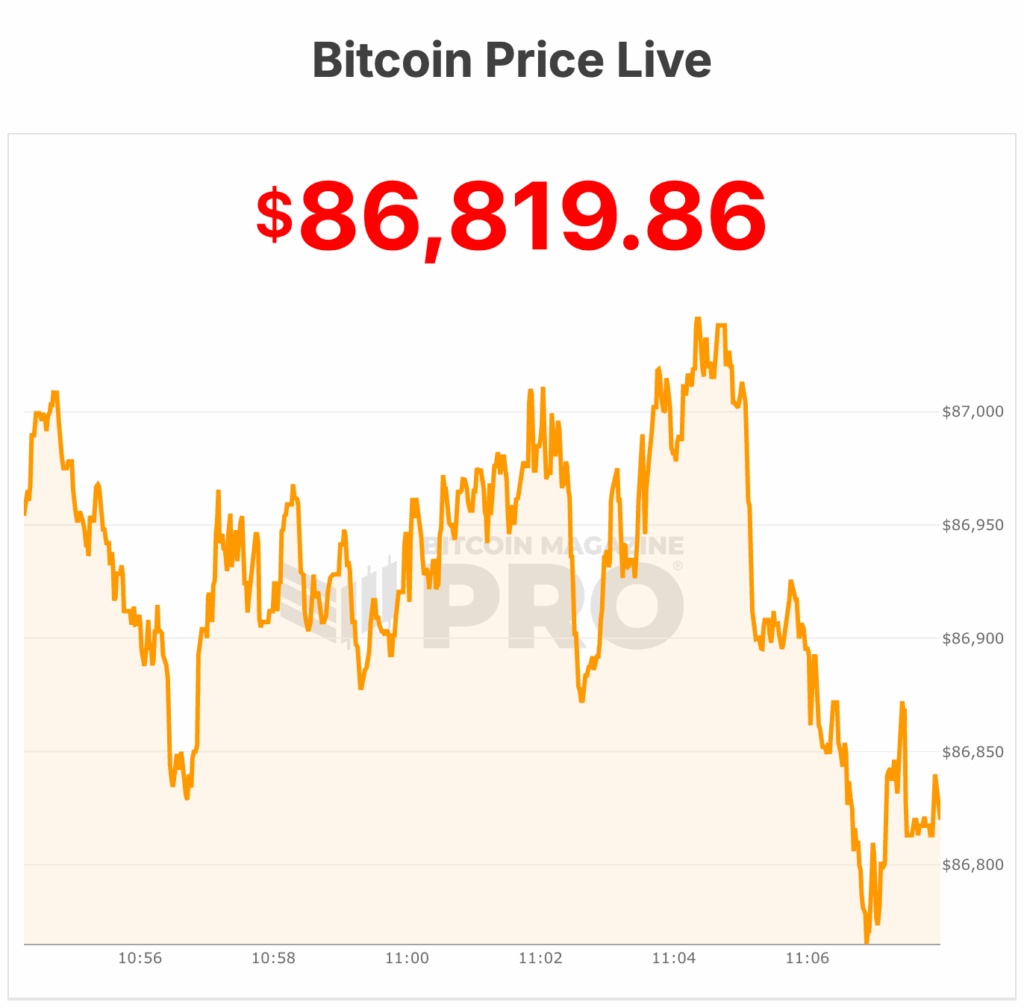

Bitcoin price is down more than 30% from its October record and continues to leak lower, slipping another 1% overnight to trade near $87,000 this morning. It’s the latest episode of a near two-month-long drawdown that has caught traders off guard.

And while the selling has slowed, the mood across markets remains fragile.

The move reflects a global risk-off tone. S&P 500 futures were slightly red after a strong rebound yesterday. Asia traded mixed. Europe opened flat-to-lower. The bitcoin price followed suit, behaving more like a high-beta tech asset than a macro hedge — a correlation that has only strengthened in recent weeks.

The slide puts the Bitcoin price back near levels where bulls say the next battle will be fought. Analysts consistently highlight the $80,000–$83,000 region as the line that must hold. That area already saved Bitcoin twice this month, including last week’s violent flush to $80,915. But each test weakens the floor.

Whale activity is sending mixed signals

New on-chain data is adding another wrinkle. Wallets holding at least 100 BTC — often viewed as mid-tier whales — are rising again after hitting a two-year low earlier this month. Santiment says these wallets have climbed by 0.47% since Nov. 11, equivalent to 91 new whale entities.

That’s a subtle but notable shift. These holders tend to scale in during deep corrections. Their return hints at early bargain hunting.

But the broader whale picture is less comforting. Wallets holding more than 1,000 BTC continue to shrink. The largest whales — those with over 10,000 BTC — trimmed around 1.5% of their holdings in October.

Citi estimates the market now lacks the spot inflow cushion normally required to stabilize prices. In their view, roughly $1 billion in weekly inflows is needed to lift the bitcoin price 4%. That demand simply isn’t there right now.

Bitcoin price: Brief rebounds, bigger questions

The Bitcoin price clawed back to $86,000 over the weekend after last week’s crash, but the bounce felt shaky. Every recovery has been capped by selling pressure near the mid-$80Ks. Earlier today, in Asia trading hours, the Bitcoin price briefly touched above $89,000 before slumping to $87,000.

That hesitation mirrors the broader macro setup. Fed Governor Christopher Waller backed a December rate cut, citing softening labor data. But he made clear the central bank remains fully data-dependent. Markets heard “maybe,” not “yes.”

Rate-cut optimism had been a major engine for the Bitcoin price’s breakout above $100K earlier this year. Now traders are grappling with uncertainty.

Meanwhile, institutional flows remain negative. Funds continue trimming exposure heading into year-end, and US regulatory drift is not helping. The Senate slowdown on digital-asset legislation has dampened confidence just as ETFs helped push new capital into the market.

Technicians eye $80,000 — and then $70,000

Technical analysts from Bitcoin Magazine say Bitcoin’s structure is damaged but not broken. The break of the multi-week broadening wedge points to a possible retest of $70,000, even if the market manages a temporary rally first.

For now, the path is simple: hold above $84,000 and bulls keep a real shot at retaking $91,400 and $94,000. Lose $84,000, and the market likely slides toward $75,000, with a break below that opening the high-volume support zone at $72,000–$69,000.

Veteran analysts note that 30% drawdowns are routine for Bitcoin. Anthony Pompliano reminded CNBC viewers yesterday that the asset has endured 21 such drops in the past decade. Seven were deeper than 50%. Bitcoin’s long-term holders tend to treat these episodes as background noise — painful, but familiar.

For now, traders are watching the charts, the whales, the Fed, and their own nerves. Bitcoin price sits at $86,819 — bruised, but not broken — waiting for its next catalyst.

This post Bitcoin Price Sits Down Over 30% From All-Time Highs as Market Waits for Next Catalyst first appeared on Bitcoin Magazine and is written by Micah Zimmerman.