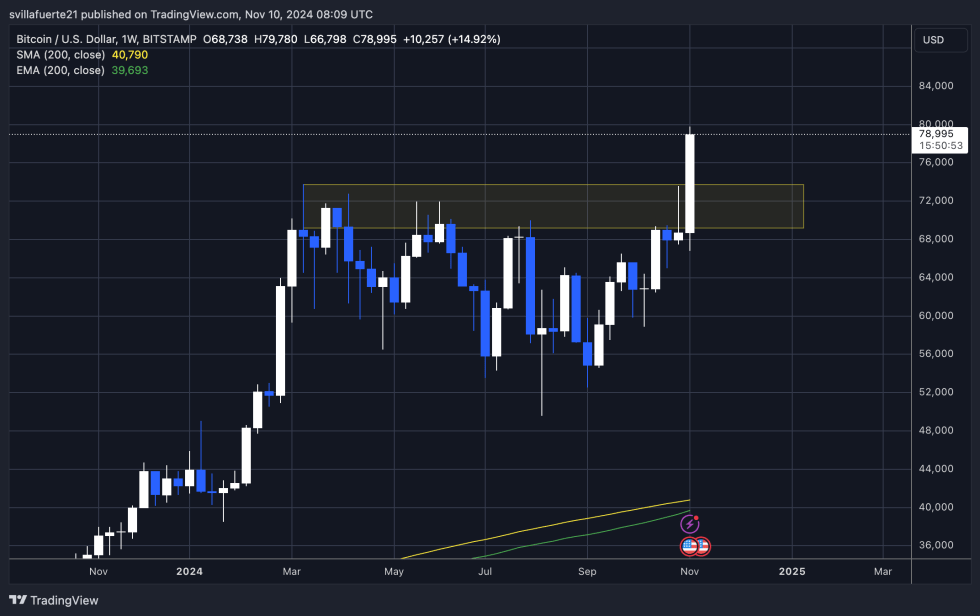

Bitcoin has shattered its all-time highs once again, reaching a new peak of $79,780. This marks the fourth time in just five days that BTC has set a record high, firmly establishing a bullish phase that began when it broke its previous all-time high in March. Market optimism surged following Donald Trump’s recent victory in the US election, adding momentum to Bitcoin’s rise.

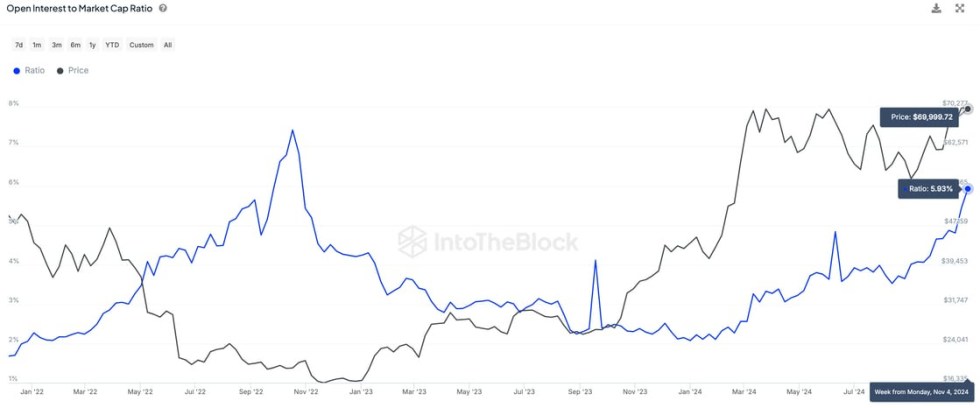

Adding to the bullish sentiment, data from IntoTheBlock shows a notable development in BTC’s open interest for perpetual swaps, with its ratio to market cap hitting a multi-year high. This metric often indicates heightened market interest and potential future volatility as traders increase leverage to capture gains in the current trend.

The next few days will be critical as investors monitor momentum and assess the potential for further upward movement. If Bitcoin maintains its position above these levels, the bull market could intensify, potentially drawing even more institutional and retail interest to the asset.

Bitcoin Bullish Phase Confirmed

Bitcoin has entered a confirmed bullish phase, supported by both price action and compelling on-chain data. IntoTheBlock recently reported that open interest in perpetual swaps has reached its highest ratio to market cap since the FTX collapse. This spike highlights intense trader interest in BTC derivatives as participants increasingly speculate on Bitcoin’s price movements through leveraged positions.

A high open interest-to-market-cap ratio can often signal heightened market expectations for significant price moves. In BTC’s case, this surge in derivatives trading suggests that traders anticipate notable volatility, either upward or downward. The amplified leverage associated with high open interest means that even small price changes can lead to substantial gains or losses for these traders, intensifying BTC’s short-term volatility.

If the price continues to rise in line with trader expectations, this elevated open interest could propel a powerful upward movement as leveraged positions gain momentum. However, this scenario comes with risks: if BTC were to reverse direction, many leveraged positions could face liquidation.

This would force traders to close out their positions at a loss, potentially triggering a cascade of liquidations that could temporarily push the price down sharply. As a result, the coming weeks could bring both significant gains and heightened volatility as Bitcoin’s bullish phase unfolds.

BTC Testing Price Discovery

Bitcoin has surged over 19% since Monday and is on track for its highest weekly close ever. The price action has confirmed a bullish trend after consistently breaking all-time highs four times in the past five days, signaling strong momentum. BTC now looks too strong to retrace significantly in the near term. However, with rising speculation and high-leverage trades entering the market, volatility could intensify in the coming days.

A pullback to the $73,800 level would maintain the bullish structure. This price point represents a key resistance level that was recently broken and could now act as strong support. If Bitcoin can hold above this level after a retrace, it would solidify the bullish trend and provide the fuel needed for further upside.

While the bullish momentum is undeniable, the increase in speculative activity and leverage could lead to sharp price swings. If the market faces a pullback, it will be important to see if key support levels like $73,800 hold. This would confirm that the trend is intact and allow Bitcoin to continue its upward trajectory without losing significant ground.

Featured image from Dall-E, chart from TradingView