The broader crypto market experienced a major crash on December 9. While the Bitcoin price dropped from $101,109 to as low as $94,150, marking a -7% decline, the altcoin market suffered significantly more severe losses. Ethereum fell by as much as -12% at one point, XRP by -22%, Solana by -15%, Cardano by -23%, Dogecoin by -19%, and Shiba Inu by -25%.

According to Coinglass data, more than 562,000 traders were liquidated in the past 24 hours, and total liquidations reached $1.7 billion. The largest single liquidation order took place on Binance in the ETHUSDT pair, valued at $19.69 million. Of the $1.7 billion in total liquidations, $1.55 billion involved long positions.

Notably, Bitcoin’s leverage flush was relatively modest compared to that of altcoins, with $143 million in BTC longs liquidated. By contrast, ETH saw $219 million in liquidations, SOL $57 million, DOGE $86 million, XRP $53 million, and ADA $22 million.

Across the entire crypto market, this represented the largest leverage flush since April 2021, when a record $10 billion in crypto futures liquidations occurred in a single day. This surpassed the previous record of $5.77 billion.

Following the flush out, Bitcoin and most altcoins staged a sharp upward recovery, although they have yet to return to their pre-crash levels. Over the past 24 hours, BTC remained down by -2.4%, ETH by -4.8%, XRP by -9.6%, SOL by -6.4%, and DOGE by -8.4%.

What Caused The Crypto Market Crash?

According to crypto analyst ltrd (@ltrd_), the underlying dynamic began with increased selling pressure on Coinbase, where traders started selling aggressively almost an hour before the major cascade. Although the ultimate plunge was triggered by a chain reaction of liquidations, this prolonged selling in the spot markets was critical in pushing prices into zones where overleveraged traders had little choice but to unwind.

Overheated funding fees and rising open interest levels meant that once the initial cracks appeared, heavily leveraged positions had no chance to escape. “How can we tell that the market was overheated? It’s simple—the Funding Fee plus the increase in Open Interest. These two factors are drivers of the current market and indicate that people are overleveraged,” ltrd explained.

When the market finally broke down, its effects were uneven. Bitcoin displayed characteristics distinct from other instruments, and Ethereum showed encouraging signs of accumulation on the way down, hinting that a major buyer could have been taking advantage of the opportunity.

Yet the truly astonishing developments occurred with XRP on Coinbase, where, as ltrd put it, “You can see something crazy—the market impacts for XRP on Coinbase are mind-boggling. Something absolutely strange happened. On a large, relatively mature market, we witnessed a cascade of big sell orders that caused the market to drop by over 5%. We don’t know exactly what happened, but it’s certainly unusual.” Ltrd speculated that these enormous and abnormal sell orders may have come from a significant player forced to liquidate at any price.

“It might be worth monitoring this situation over the next few days. Perhaps a major player was forced to sell as if there were no tomorrow,” he mused. The consequence of such an event, even in supposedly deeper markets, was a swift crash that spilled over into perpetual swaps trading elsewhere, triggering further liquidations.

According to ltrd, “When something like this happens, it’s typically a cascade of unintentional orders. Market makers absorb this selling pressure and hedge it, causing signal propagation across the exchanges.” Even large-cap altcoins like XRP, which have market caps on par with major US companies, still face liquidity constraints that become glaringly apparent under stress. “Relative to these market caps, the liquidity in the market is still poor,” he noted, explaining how this contributes to the observed volatility and the dramatic nature of such events.

As prices eventually stabilized and began to bounce from their lowest points, ltrd highlighted how this pattern is common in overheated markets: “The next thing you always see in a hot market is a quick price reversal from the lowest point. There are a huge number of liquidations, limited liquidity, and still many players in profit who want to buy the dip. Let’s see who comes out as the winner.”

Macro analyst Alex Krüger placed the entire event into a broader perspective. “Nothing’s changed. Expect prices to still go up,” he stated, while noting that future conditions, such as a pro-crypto US administration under Donald Trump, could set a more constructive backdrop for digital assets.

Although Krüger cited the possibility of more leverage flushes in the coming months, he viewed these events as a normalizing force. “Today’s was a major leverage flush out. Mainly for altcoins. Very normal in hot and highly levered markets. This is how crypto baptizes newcomers and keeps crypto natives disciplined,” Krüger said, and added “Never fun to be caught long in a leverage flush out. But that’s what this is. Funding back to the base line across the board. This time alts as well. Expect a few more of this in the next few months.”

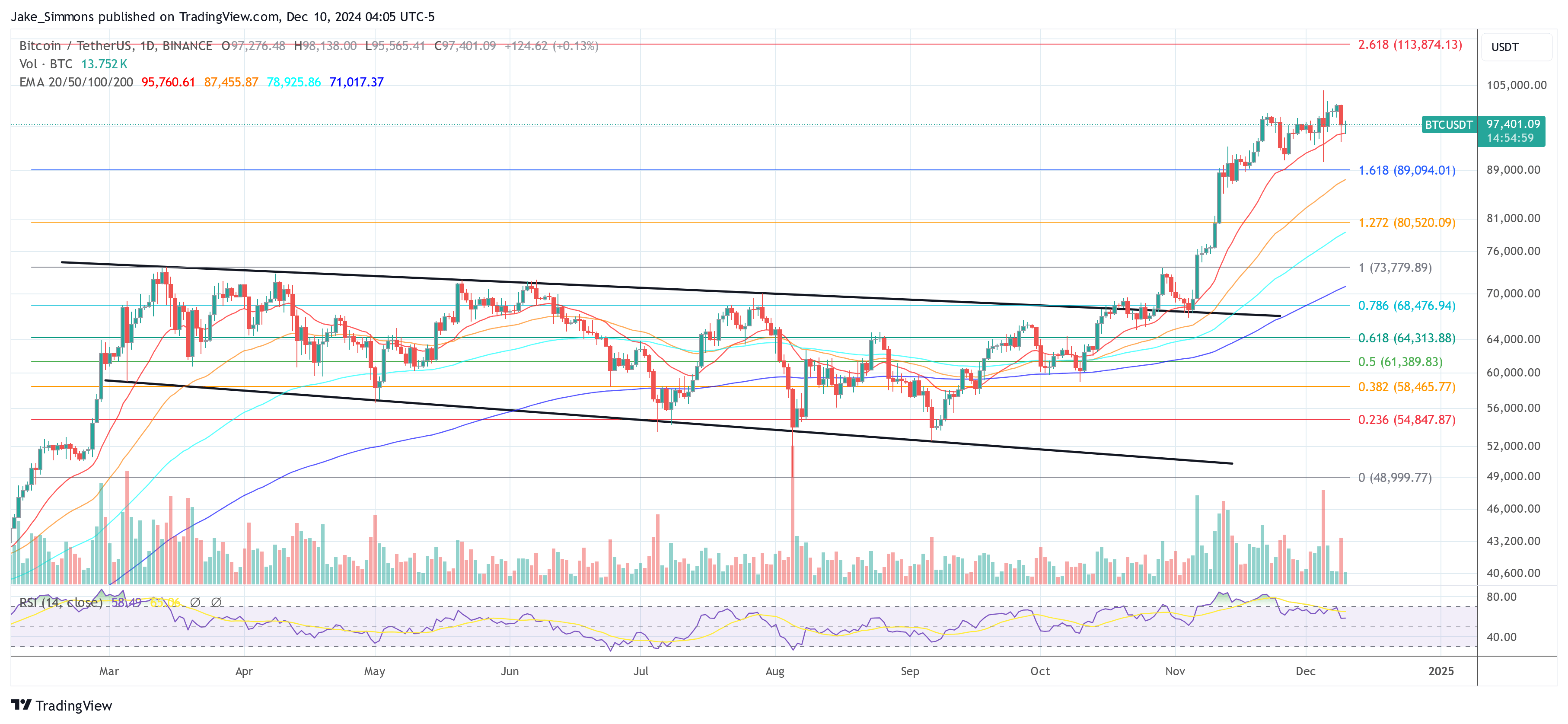

At press time, Bitcoin traded at $97,401.