Bitcoin is about to close another week below the critical $90,000 level, fueling bearish sentiment across the market. Despite a short-term bounce earlier in the week, the inability to reclaim higher ground continues to worry investors. Global tensions remain elevated as US President Donald Trump intensifies his trade war with China. Although a 90-day tariff pause was granted to all countries except China last week, uncertainty lingers, and markets remain on edge. Trade relations between the U.S. and China continue to define broader economic sentiment, affecting high-risk assets like Bitcoin.

Volatility remains low, but many believe that won’t last much longer. Top analyst Big Cheds shared a technical chart on X showing that Bitcoin’s 1-hour Bollinger Bands are now tightening — a classic signal that a major move may be imminent. These “pinching” bands typically suggest compression in price action, often preceding a breakout or breakdown.

With BTC stuck in a narrow range for several days, traders are bracing for sharp movement in either direction. Whether this upcoming move leads to a bullish reversal or further downside remains uncertain, but current conditions suggest that volatility is set to return in the coming sessions.

Bitcoin Consolidates As Macroeconomic Tensions Shape Market Outlook

Bitcoin is now closely tracking the broader macroeconomic narrative, with the escalating trade tensions between the US and China weighing heavily on global market sentiment. The threat of a global recession is growing as both nations double down on tariff measures, creating an unstable environment for risk assets. In this backdrop, Bitcoin has entered a consolidation phase after enduring weeks of aggressive selling pressure and heightened uncertainty.

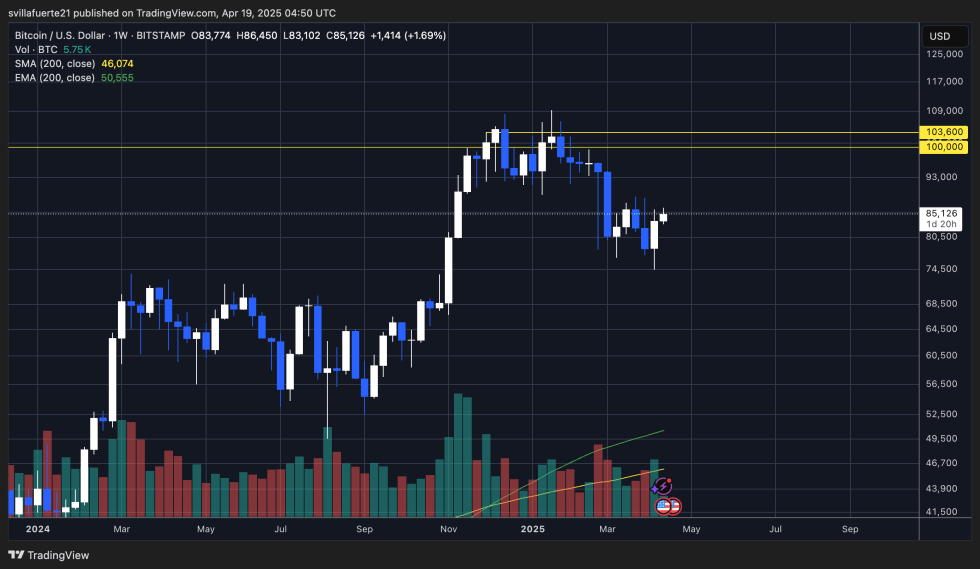

Currently trading below $86,000 but holding firm above the $82,000–$81,000 support zone, BTC is navigating a tight range with no clear direction. Analysts are increasingly divided: some warn that BTC may have already entered a bear market, pointing to the failed expectations of a bullish breakout this year. The market’s inability to reclaim key moving averages has further amplified those fears.

Still, there remains a pocket of bullish optimism. Many investors believe Bitcoin could rally above the $100,000 mark once macro conditions stabilize and capital returns to high-conviction assets. Supporting this view, Cheds highlighted on X that Bitcoin’s 1-hour Bollinger Bands are now “pinching,” a technical setup that often precedes significant price moves.

As volatility compresses and external economic factors dominate headlines, the coming days may determine Bitcoin’s next major leg.

Price Struggles Below $90K: Weekly Close Looms

Bitcoin is currently trading at $85,000 and is on track to confirm its seventh consecutive weekly close below the $90,000 mark. This extended period beneath a key psychological and technical resistance has intensified concerns among market participants about the strength of the current recovery attempt. Bulls must reclaim the $90K level quickly to confirm a shift in momentum and initiate a proper recovery phase.

Failing to break above this threshold would likely result in continued weakness, with a sharp retrace toward the $80K–$78K region highly probable. The $90K barrier has become a crucial pivot point, not only for short-term sentiment but also for defining the broader trend direction. A decisive push above this zone, especially with strong volume and follow-through, could propel Bitcoin directly toward the $95K level, potentially reigniting bullish momentum.

However, with market volatility still muted and macroeconomic uncertainty pressing on investor sentiment, BTC remains range-bound and indecisive. Until buyers take clear control, Bitcoin’s price action may continue to grind sideways or tilt lower. All eyes now turn to the weekly candle close as traders await a breakout or breakdown that could define Bitcoin’s trajectory in the weeks ahead.

Featured image from Dall-E, chart from TradingView