Bitcoin has gained over 28% in value since its April 7th low, marking a strong recovery that has shifted market sentiment in favor of the bulls. The leading cryptocurrency is now holding firmly above the $90,000 level, a key psychological and technical zone that suggests momentum is back on the side of buyers. However, risks still remain, as a definitive push above the $100,000 mark is needed to confirm a full bullish continuation and break into new all-time highs.

Despite ongoing macroeconomic uncertainty and global trade tensions, Bitcoin appears to be showing resilience. Analysts are watching closely to see if the current structure holds, especially as volatility remains elevated.

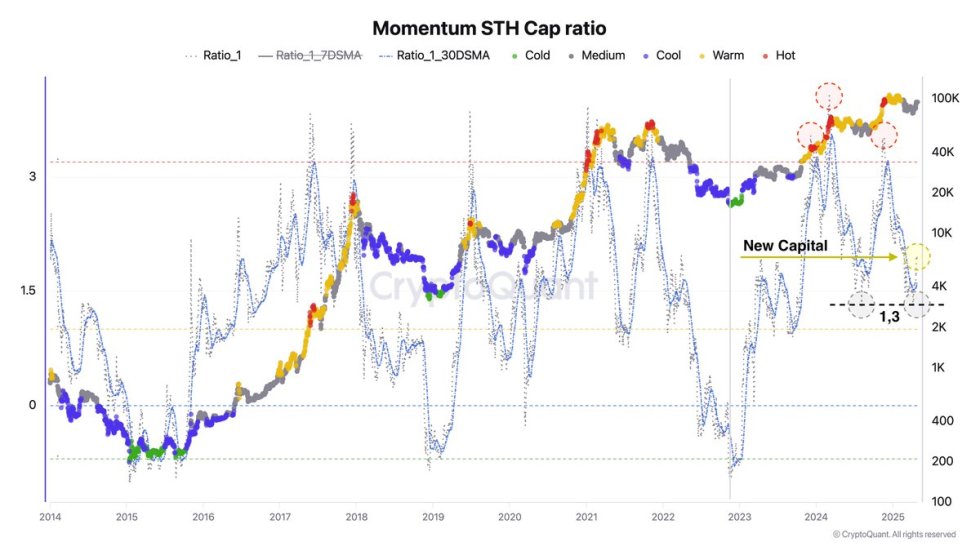

Adding to the bullish outlook, recent data from CryptoQuant reveals a notable trend: after weeks of market cooldown and correction, a fresh wave of new capital is flowing into the market. This renewed inflow of money indicates increased confidence among investors and could fuel the next leg higher.

If this wave of accumulation persists, it could serve as the foundation for a broader uptrend — one that potentially pushes BTC beyond $100K and into uncharted territory.

Bitcoin Builds Momentum During Uncertainty

Bitcoin appears to have finally broken its short-term correlation with U.S. equities. While the stock market stalled last week under pressure from mixed earnings and rising macroeconomic concerns, BTC surged, gaining strong bullish momentum. This divergence may mark the beginning of a new trend — one where Bitcoin and the broader crypto market lead risk-on assets into higher territory. However, traders and investors alike remain cautious, as macroeconomic risks continue to loom, particularly surrounding the intensifying trade conflict between the US and China.

The coming weeks are likely to be critical for Bitcoin’s direction. As the price continues consolidating in a narrow range between $92K and $96K, the market is anticipating a breakout. Whether that breakout is higher or lower will largely depend on the liquidity shift and global financial developments.

Supporting the bullish case, top analyst Axel Adler shared on-chain insights highlighting that the Momentum STH Cap Ratio — a metric designed to track shifts in short-term investor behavior — shows that a new wave of capital has entered the market following the April correction. According to Adler, this renewed influx of money suggests growing speculative interest and potential for sustained upside.

This fresh capital inflow could be the key trigger Bitcoin needs to push toward new all-time highs, provided bulls maintain control and global economic conditions don’t worsen dramatically. The next move will likely define the market’s sentiment for the months ahead.

BTC Price Struggles Below $96K, but Bulls Hold the Line

Bitcoin is currently trading at $95,000 after several days of consolidation near resistance. While bulls have struggled to reclaim higher ground above the $96K mark, there are encouraging signs. BTC has held the $92K support level with notable strength since pushing past $90K last week — a key psychological and technical milestone.

This sustained support zone signals strong underlying demand, especially after weeks of selling pressure and macroeconomic uncertainty. For the bullish momentum to continue, however, BTC must break above the $96K barrier. A clean move above this level would set the stage for a potential run toward $100K — a level many analysts see as the next critical breakout zone.

Still, downside risks remain. If BTC fails to gather momentum above $96K soon, the market could shift into a prolonged consolidation phase. In this scenario, holding above $90K becomes essential to avoid triggering deeper corrections.

As global financial markets continue to navigate tensions between the U.S. and China, Bitcoin’s price action this week may provide key signals about investor confidence and the strength of the current trend. For now, the $90K–$96K range remains the battleground.

Featured image from Dall-E, chart from TradingView