Bitcoin is at a crossroads as market participants grow increasingly divided on its next move. Bulls remain hopeful for a breakout above the all-time high (ATH) near $112,000, while bears argue that a deeper correction is imminent. The current indecision is reflected in the price action, with BTC struggling to gain traction after its recent pullback, and volatility climbing amid growing macroeconomic and geopolitical tensions.

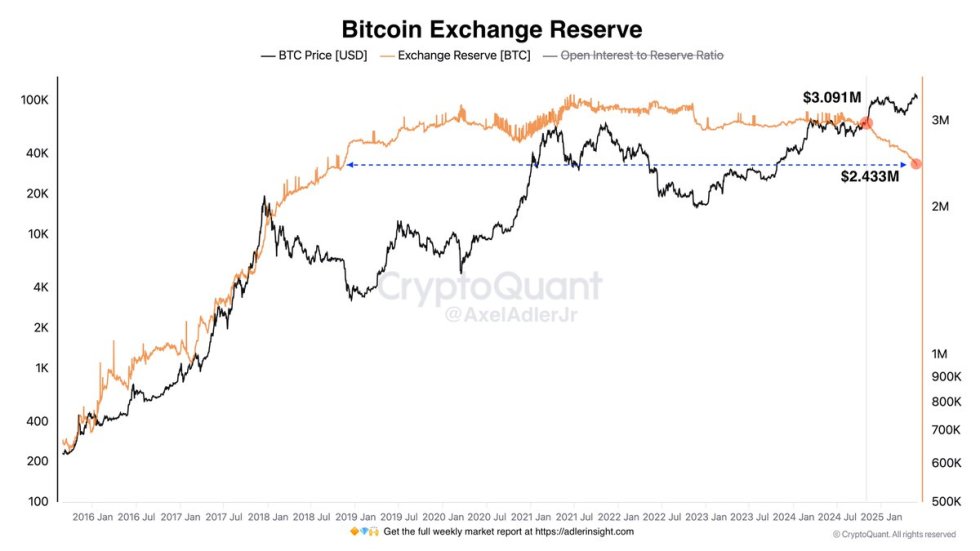

Analysts agree that a decisive move is coming, and all eyes are on on-chain data for clues. According to CryptoQuant, since November 2024, centralized exchange (CEX) reserves have dropped by 668,000 BTC—a strong long-term bullish signal suggesting continued accumulation and reduced selling pressure. However, while the decline in reserves is notable, it’s far from signaling exhaustion.

This divergence between bullish and bearish narratives sets the stage for a critical moment in Bitcoin’s cycle. Whether a supply squeeze triggers the next leg up or rising global uncertainty leads to further retracement, the coming days will likely define BTC’s short-term trajectory.

Bitcoin Holds Crucial Support As Uncertainty Rattles Sentiment

Bitcoin is currently trading at a key juncture, holding above critical demand levels but failing to confirm a decisive breakout above the $112,000 all-time high. The asset has shown resilience after a 7% pullback, but a lack of strong momentum has left the market in a state of uncertainty. Analysts remain divided, with some anticipating a renewed bullish impulse while others warn of a larger correction amid rising volatility.

The macroeconomic backdrop adds to the unease. The aggressive and unpredictable bond market continues to shape global risk dynamics, with surging US Treasury yields signaling systemic stress that could ripple through crypto markets. Traders are becoming more cautious, and sentiment has shifted into a more defensive posture.

Still, on-chain data offers a glimmer of long-term optimism. According to top analyst Axel Adler, centralized exchange (CEX) reserves have fallen by 668,000 BTC since November 2024. This notable decline signals reduced selling pressure and increased confidence among long-term holders. However, it’s premature to declare reserves depleted. As of now, there are still 2,432,989 BTC available across exchanges.

At current market prices, it would take over a quarter-trillion dollars—approximately $253.4 billion—to absorb that liquidity entirely. This massive capital requirement suggests that while bullish signals are emerging, the market remains far from a true supply squeeze. Until BTC reclaims $112,000 with conviction, investors should prepare for further consolidation or even deeper retests.

BTC Price Analysis: Resistance Still Looms

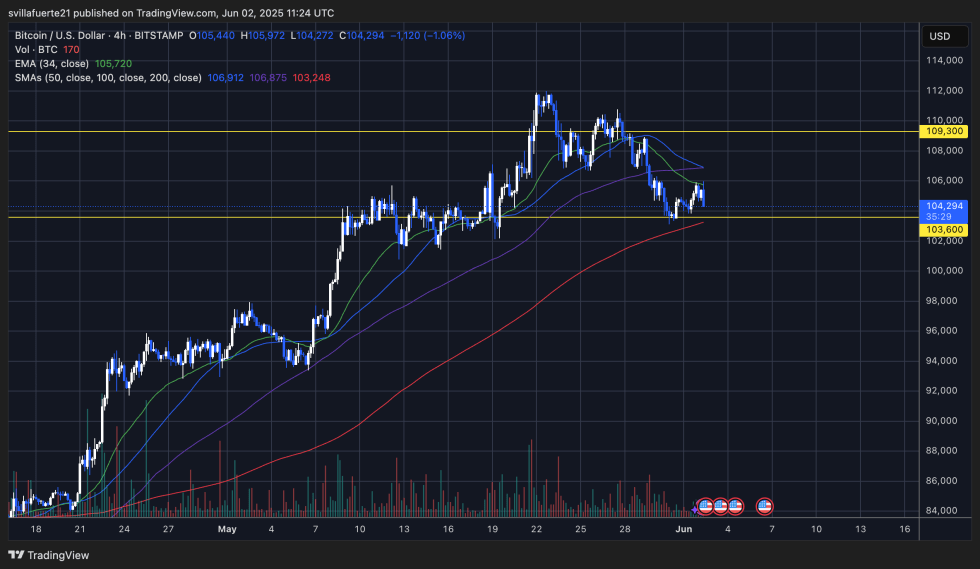

Bitcoin is holding above a key support zone around $103,600 after bouncing off this level earlier in the day. The 4-hour chart shows BTC attempting a recovery, with short-term resistance now forming near the 34-EMA ($105,720), which aligns closely with the 50 and 100 SMA cluster. A break above this confluence could open the door to retest the $109,300 resistance—a level that capped the previous rally and triggered the current correction.

Volume remains modest, suggesting a lack of strong conviction from bulls or bears. However, the 200 SMA is still sloping upward and sits below current price action, providing structural support near $103,200.

If BTC fails to reclaim the $106K range, further consolidation is likely, and a clean break below $103,600 could expose the market to deeper retracement toward $100K psychological levels.

Bulls must clear $106K to regain short-term momentum, while bears will be eyeing a breakdown below $103.6K to gain control. With macro volatility rising and on-chain data showing strong accumulation from large holders, the next few sessions could offer more clarity on BTC’s short-term direction.

Featured image from Dall-E, chart from TradingView