Global Macro Investor’s head of research Julien Bittel used a marathon X thread on 9 June to stitch together what he calls “The Everything Code”―a demographic-debt-liquidity feedback loop that he believes will catapult the digital-asset complex from today’s roughly $3.5 trillion capitalization to $100 trillion within a decade.

Speaking against the backdrop of a crypto market that has already doubled since the start of 2024, Bittel lays the groundwork with a blunt diagnosis of the developed world’s labour market. “The labor force participation rate isn’t going to rise anytime soon – it’s set to keep declining over time. This is a structural problem,” he writes, adding that “humans are already being replaced by AI and robots at a staggering pace, and that shift is only just beginning. This is deflationary.” In his view, shrinking workforces meet unyielding entitlement promises in a cocktail that “reinforces the need for ongoing stimulus to keep the system afloat. Fewer workers. More tech. Same debts.”

Bittel’s next step is the fiscal arithmetic. With public and private liabilities already hovering near 120% of global GDP, “the only answer is more debt… That’s how the system survives,” he warns. Should growth sputter, “Debt-to-GDP is going to keep rising over time,” a trend he expects policymakers to absorb through monetary debasement rather than austerity.

Debasement, he reminds readers, is the hidden eight-percent annual loss of purchasing power that piles on top of headline inflation. “Cash has quietly become one of the riskiest assets out there,” Bittel argues, forcing savers to seek double-digit nominal returns simply to stand still.

The $100 Trillion Crypto Supercycle

From there the thread pivots to liquidity, the variable Bittel and GMI founder Raoul Pal have elevated to first-principles status. When GMI combines central-bank balance-sheet expansion with commercial-bank credit creation across major economies, the resulting “Total Liquidity” gauge explains about 90% of Bitcoin’s moves and 95% of the Nasdaq-100’s, he writes. “Fewer workers. More tech. Same debts,” means liquidity must keep rising to prevent a credit contraction, and that liquidity, in Bittel’s models, “is the tide that lifts scarce, risk-sensitive assets.”

Scarcity is the bridge to Bitcoin. “Bitcoin has been compounding purchasing power faster than any asset in human history—annualizing nearly 150 percent in excess of the debasement rate since 2010,” Bittel notes, while even the Nasdaq’s stellar 13 percent real return “is down 99.94 percent versus Bitcoin since the start of 2012. Shocking…” The superlatives serve a purpose: they frame Bitcoin as the only macro-scale antidote to the policy cocktail of demographic drag, rising leverage and forced liquidity.

All of that funnels into his headline projection. “We’re still in the early stages of a global race—a scramble by institutions, sovereigns, and individuals—to accumulate as much Bitcoin as possible,” Bittel writes. That scramble, he believes, will propel the crypto universe “from a $3 trillion asset class today to $100 trillion over the next seven to ten years.”

Doing the math, a jump from the current $3.55 trillion market capitalisation implies a 40% compound annual growth rate over a decade, or roughly 61% if the window compresses to seven years—both aggressive, but neither without precedent in earlier crypto cycles.

Bittel concedes the path will be “both incredibly challenging and unimaginably rewarding—the worst of times and the best of times,” but he insists Bitcoin is “part of the solution.” He and Pal have called the coming chase for scarce assets “the single greatest wealth-creation opportunity of our lifetimes,” and Bittel closes the thread by declaring that if GMI’s call plays out, it will be “remembered as the greatest macro trade of all time. This is The Everything Code.”

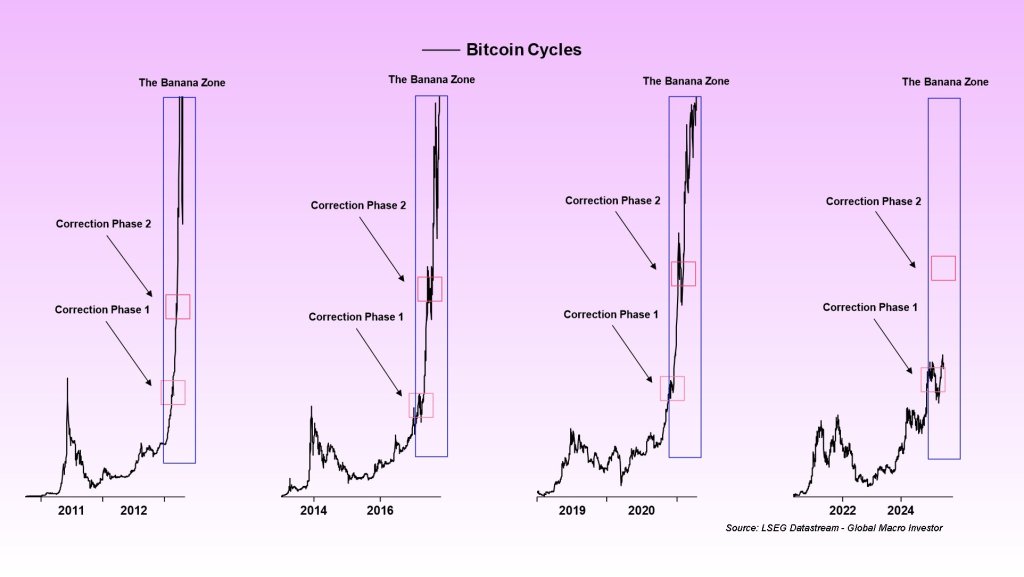

Pal, whose own presentation at Real Vision’s Sui Basecamp in May framed crypto as “a supermassive black hole that outperforms and sucks in every other asset,” reaches similar conclusions. He places Bitcoin in what he calls the “banana zone,” a reflexive phase in which expanding liquidity and herd behaviour interact to drive parabolic gains, with a cycle target of roughly $450,000 per coin. Pal’s estimates implies a Bitcoin capitalization only well above $40 trillion even without altcoins—complementing Bittel’s upper-bound scenario.

At press time, the total crypto market cap stood at $3.37 trillion.