Bitcoin saw a sharp retracement to $102,300 after briefly climbing to $106,500 earlier today, as bulls failed once again to break through critical resistance. Sellers are stepping in at key supply zones, pushing back against attempts to enter price discovery above the $112K all-time high. Despite this pressure, Bitcoin remains resilient above the psychologically significant $100K mark, where it has found support since early June.

The latest on-chain data from Gemini and Glassnode reveals a noteworthy structural shift: over 30% of Bitcoin’s circulating supply is now held by just 216 centralized entities. These include exchanges, ETFs, funds, public and private companies, DeFi contracts, and even governments. Exchanges currently hold the largest share, while public companies represent the most numerous holders. This trend highlights the deepening custodial centralization of Bitcoin, raising both adoption optimism and decentralization concerns.

As the macroeconomic backdrop remains volatile—with high US Treasury yields, the Fed holding interest rates, and geopolitical tensions intensifying—Bitcoin’s price action is becoming increasingly sensitive to shifts in sentiment and liquidity. Whether BTC can hold this key support or slide deeper into correction will depend on upcoming volume reactions and potential moves from these dominant custodial players.

Centralization And Geopolitics Shape Bitcoin’s Next Move

Bitcoin is currently down 8% from its $112K all-time high, hovering in a broad consolidation phase with no decisive breakout. The price action suggests that the market is at a critical juncture, with traders split between two possibilities: a deeper retracement toward the $94K level or a renewed push into price discovery. This indecision is amplified by ongoing geopolitical tensions, particularly the escalating conflict between Israel and Iran. Many analysts warn that if the United States steps in, it could trigger panic across global markets, creating spillover effects into the crypto space.

Meanwhile, key insights from Glassnode and Gemini shed light on a growing trend in Bitcoin’s ownership structure. Over 30% of the circulating supply is now held by just 216 centralized entities. This reflects a dual narrative—on one hand, increasing institutional adoption of Bitcoin as a reserve or investment asset, and on the other, rising custodial centralization that may undermine the network’s decentralized ethos.

The largest holdings belong to crypto exchanges, ETFs, and funds, followed by public and private companies that have allocated BTC to their balance sheets. A notable portion is also locked in DeFi contracts, with some controlled by governments following seizures or strategic acquisitions.

While this growing centralization may boost credibility and capital inflow, it also introduces new risks to liquidity and distribution. In such a fragile macro environment, Bitcoin’s next major move will depend not only on technical setups but also on the behavior of these key holders under pressure.

BTC Price Analysis: Bulls Lose Momentum

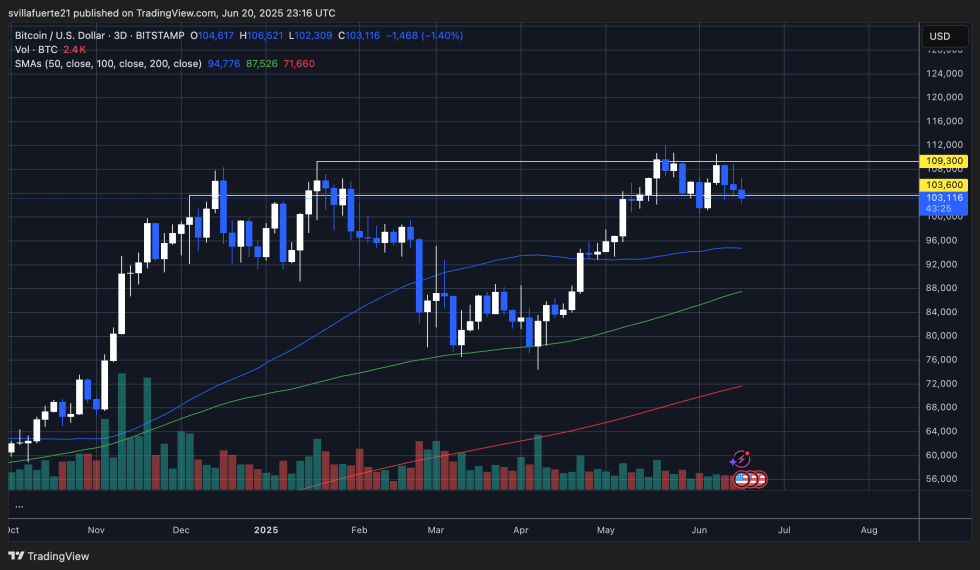

Bitcoin has retraced from its recent local high of $106,500 and is now trading around the $103,100 mark, testing a key support level highlighted in yellow on the chart—specifically the $103,600 zone. This level served as resistance earlier in the year and is now acting as a critical demand area during this consolidation phase. A daily or 3-day close below this threshold could signal further downside and open the door for a retest of the $100,000 psychological support.

The chart shows lower highs forming since the $112,000 all-time high, which, if continued, may form a descending triangle structure—typically a bearish continuation pattern. Price rejection around $109,300 confirms that sellers remain in control at higher levels. Volume is slightly elevated on red candles, suggesting increased distribution.

The 50 and 100 moving averages (at approximately $94,700 and $87,500, respectively) remain well below the current price, indicating room for further retracement if bearish momentum builds. Still, the broader uptrend remains intact unless price decisively breaks below the $100,000 level.

Bulls need to reclaim $106,500 and close above $109,300 to signal strength. Until then, Bitcoin appears locked in a tightening range, with downside risk increasing in the short term.

Featured image from Dall-E, chart from TradingView