Bitcoin volatility is back on the rise after a dramatic week of price action. On Monday, BTC surged to a new all-time high of $123,200, only to retrace to $115,700 by Tuesday, highlighting the fast-paced, high-stakes environment that has returned to the crypto market. Despite the sharp pullback, the overall trend remains bullish, with price structure and momentum still favoring the bulls.

Bitcoin has held above key support levels, and buyers continue to step in on dips, reinforcing confidence in the ongoing uptrend. The recent move is viewed by many as a healthy correction rather than a reversal, especially given the macro backdrop and rising institutional involvement.

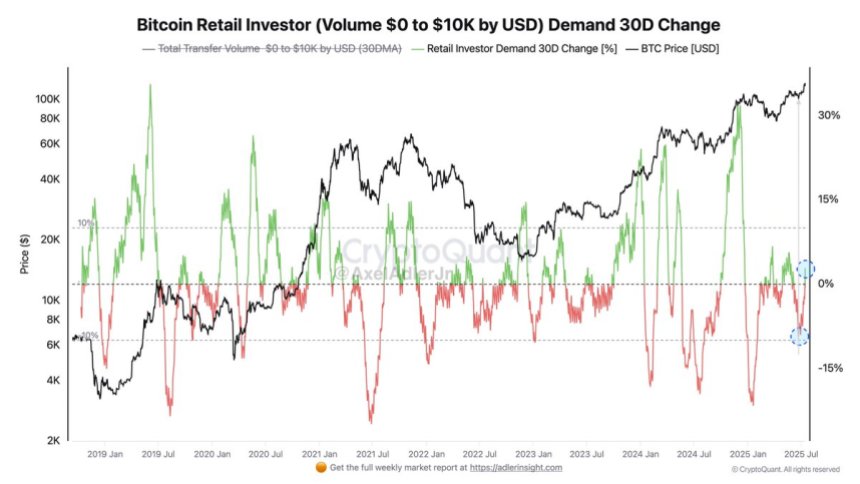

Adding to the bullish narrative, CryptoQuant data reveals that retail investors are making a comeback. The 30-day change in demand for small BTC transfers (ranging from $0–$10K) is signaling renewed interest from retail investors.

Retail Demand Reawakens As Crypto Week Advances In Washington

Top analyst Axel Adler has highlighted a critical on-chain signal that points to the return of retail investors in the Bitcoin market. The 30-day change in demand for small transfer volumes ($0–$10K) has moved out of negative territory for the first time in months. This shift indicates a meaningful increase in activity from smaller holders—widely interpreted as retail participants—after a prolonged period of dormancy.

Retail involvement plays a crucial role in sustaining long-term bullish trends. While institutional demand often drives initial breakouts, it is the broad participation from everyday investors that adds momentum and staying power to rallies. The reappearance of retail buying interest not only strengthens Bitcoin’s current price structure but also suggests growing confidence in the asset’s outlook, despite recent volatility.

This renewed demand comes at a pivotal time. “Crypto Week” is underway in the US Congress, where lawmakers are actively debating and voting on three major cryptocurrency bills. The outcomes of these discussions are expected to shape the regulatory landscape for years to come and could provide the clarity that both retail and institutional investors have long awaited.

For now, the uptick in small-scale BTC transfers is a strong signal. That retail investors are re-engaging just as the crypto industry prepares for potentially historic policy changes.

BTC Holds Above $118K After Reclaiming Breakout Zone

Bitcoin is currently trading at $118,914 on the daily chart. After a sharp rally pushed it to a new all-time high of $123,200 earlier this week. The price has since retraced, but BTC continues to hold above key support levels, signaling bullish resilience. The recent dip toward $117,000 was met with buyer interest, as seen in the long lower wick and a moderate bounce on rising volume.

The chart shows that BTC is comfortably trading above the 50-day, 100-day, and 200-day simple moving averages (SMAs). Currently at $108,040, $102,116, and $97,362, respectively—all of which are upward sloping. This confirms a strong bullish structure, with momentum still favoring buyers in the medium to long term.

With volatility increasing and volume surging, Bitcoin’s consolidation above $118K could act as a launchpad for a second leg higher. A strong close above $120K would likely confirm continued bullish momentum heading into the final stretch of “Crypto Week.”

Featured image from Dall-E, chart from TradingView