Bitcoin faced a swift correction below the $125,000 level after reaching a new all-time high of $126,200 on Monday, triggering widespread volatility across the market. The price retraced over 4% to around $120,000, liquidating millions in leveraged positions as traders anticipated further upside. The move caught many off guard, especially after days of strong momentum and renewed optimism that Bitcoin was preparing to enter another price discovery phase.

Despite the pullback, key on-chain data reveals a contrasting trend beneath the surface — a massive accumulation by US investors. Analysts note that while short-term traders faced liquidations, spot demand from US-based buyers continues to grow, particularly through regulated platforms and ETFs. This steady inflow of capital provides a strong foundation for long-term market strength, even amid short-term volatility.

The correction may have flushed out excessive leverage, resetting market conditions for a healthier continuation. As Bitcoin consolidates around the $120,000–$122,000 range, analysts are watching closely to see whether institutional accumulation can offset the selling pressure. For now, the broader trend remains bullish, with growing evidence that US investors are using every dip to increase exposure to the world’s leading digital asset.

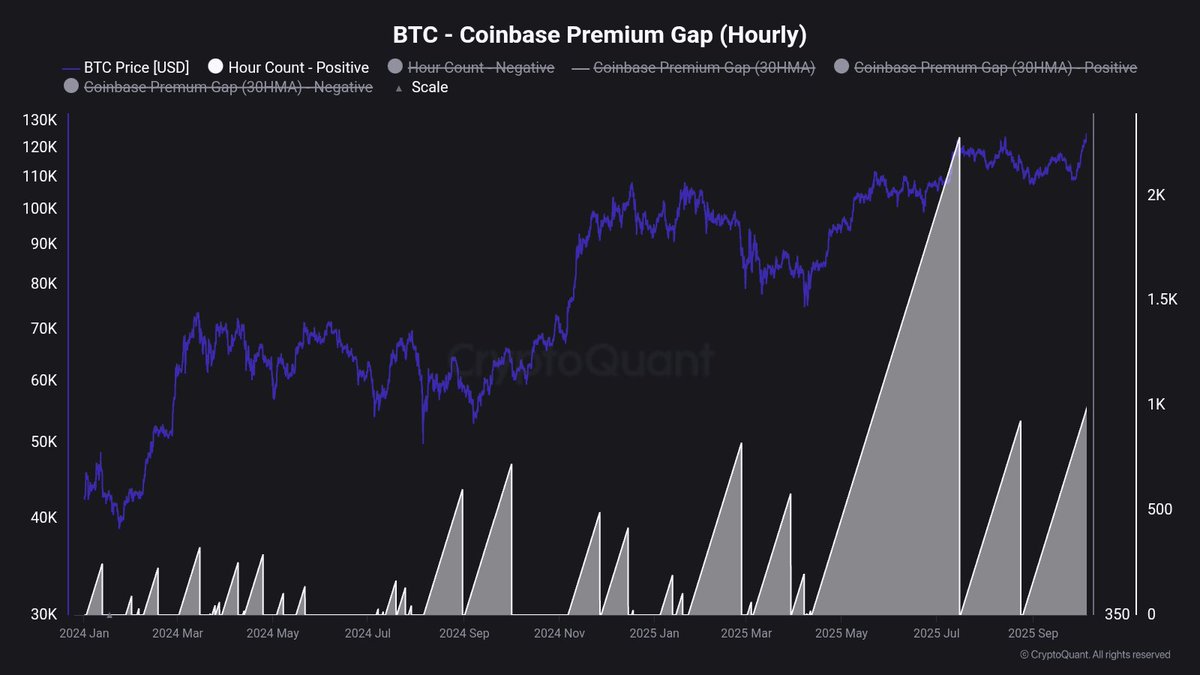

US Demand Surges As Coinbase Premium Gap Signals Accumulation

Top onchain analyst Maartunn shared new data revealing a sharp increase in US-based Bitcoin accumulation, driven largely by activity on Coinbase, one of the most influential exchanges for institutional and retail investors in the United States. According to his insights, the Coinbase Premium Gap — which measures the price difference of Bitcoin between Coinbase and other global exchanges — has surged to its second-highest level since the ETF launch earlier this year.

This spike signals an aggressive buying spree from US investors, suggesting strong spot demand that is outpacing global averages. Historically, similar jumps in the Coinbase Premium Gap have coincided with phases of major market expansion, often preceding new highs as US capital flows into Bitcoin-led rallies. The data indicates that US traders are willing to pay a higher premium compared to their counterparts on platforms like Binance or OKX — a clear expression of localized demand.

Analysts interpret this as a bullish signal in the context of Bitcoin’s current consolidation near all-time highs. After a brief correction from $126,000 to $120,000, strong institutional interest could provide the liquidity needed for a new breakout. Many market watchers believe that such robust accumulation is rarely random; it often precedes a significant expansive move, as buyers position themselves before another upward leg.

If this buying pressure sustains, Bitcoin could soon reclaim its highs and enter a new phase of price discovery. Combined with growing ETF inflows and steady US accumulation trends, Maartunn’s data reinforces the narrative that the market’s next major impulse may once again be led by US demand — the same catalyst that ignited Bitcoin’s previous all-time high breakout earlier this year.

Bitcoin Consolidates After Sharp Rally

Bitcoin is currently trading around $122,500, showing signs of stabilization after the recent surge to an all-time high near $126,000 earlier this week. The chart highlights a healthy pullback from the highs, with BTC finding support just above the $120,000 level — a zone that previously acted as resistance and has now turned into a short-term support range.

The 8-day and 21-day moving averages are trending upward, confirming the continuation of a bullish structure. Meanwhile, the 50-day moving average remains below the price, indicating that momentum still favors the bulls despite short-term volatility. If Bitcoin manages to hold above the $120,000–$121,000 region, the setup could attract renewed buying pressure for another attempt to break above the $125,000 resistance.

However, failure to maintain these levels could open the door for a retest of the $117,500 area, where the next major support lies. This would still be within a healthy correction range following the recent 15% rally. Overall, Bitcoin’s structure remains bullish, with strong higher lows forming and institutional demand — led by Coinbase inflows — continuing to support the market. A decisive move above $125,000 could signal the beginning of a new price discovery phase.

Featured image from ChatGPT, chart from TradingView.com